- Trading

Trading

-

CFD Trading

What is CFD Trading How to Trade CFD Why Trade CFD CFD Trading Strategies

- All Trading Products

-

Markets

All Instruments Forex CFDs Indices CFD Commodities CFD Stocks CFD ETFs CFD Bonds CFD Cryptocurrency CFDs

- Trading Accounts

- Trading Fees

- Trading Leverage

- Trading Server

- Deposit & Withdrawal

- Premium Services

-

CFD Trading

- Platforms

- Academy

- Analysis

- About

-

AllTradingPlatformsAcademyAnalysisAbout

-

Search query too short. Please enter a full word or phrase.

-

Keywords

- Trading Accounts

- TradingView

- Trading Fees

Popular Search

- Trading Accounts

- MT4

- MT5

- Professional Trading Accounts

- Academy

What is forex day trading?

Forex day trading refers to the practice of trading currencies on the foreign exchange (forex) markets using short-term strategies. In day trading, positions are held open for short durations – spanning minutes to hours – but not overnight, hence its name.

The forex market offers dynamic price action, with various currencies rising and falling against one another throughout the trading day. This creates a steady stream of trading opportunities for forex traders using CFDs (Contracts for Difference). When coupled with leverage, which is a key feature of CFD trading, the daily fluctuations in currency pairs can offer potential profit opportunities. However, it's important to note that leverage in CFD trading can also magnify losses, so proper risk management is crucial.

Do many people day trade forex?

Forex day trading using CFDs is a popular approach among traders, though it’s important to note that it can be high risk, especially for beginners. Understanding the risks involved is crucial before starting. The forex market is particularly suitable for CFD day trading due to its dynamic price movements and high liquidity, offering numerous trading opportunities each day. CFDs allow traders to speculate on price movements without owning the underlying currency, making it easier to take both long and short positions.

The forex market is highly suitable for day trading, as it offers dynamic price movements and deep liquidity – facilitating an array of trading opportunities throughout market hours. Because the typical price movement in a forex currency pair is small (barring economic shocks), such movements are best captured across a continuing series of trades.

Additionally, forex day traders avoid overnight holding fees and reduce the risk associated with market gaps caused by after-hours events.

5 popular forex trading strategies

The dynamic forex market is the most widely traded financial market in the world. Here are five trading strategies that demonstrate the versatility and potential of forex day trading.

Range trading

The range trading strategy works well with a currency pair that is consolidating within a well-defined range. That’s to say, the pair is seen to consistently bounce between a lower value (area of support) and a higher value (area of resistance).

Once the core support and resistance levels are established, the idea is to sell when the price hits the area of key resistance and buy when the price hits the area of key support. To avoid the risk of breakouts, traders should check that that currency pair is not trending or gathering momentum.

Breakout trading

In breakout trading, a forex day trader looks for instances where the price breaks out of a previous range, placing a trade at the right moment to profit from the breakout. The idea is that when a currency pair breaks above a key resistance area, there is momentum for the pair to continue riding higher. Similarly, if a currency pair breaks below a key support level, there is momentum for the pair to continue riding lower.

Thus, knowing how to read momentum in price action is important in breakout trading, as is the awareness of forex pairs that have been in consolidation and are due for a breakout.

Trend trading

A simple but effective forex day trading strategy, trend trading is when the trader trades along with the trend. This means identifying the trend the price is in and placing trades accordingly.

A trend trader would continue following the trend until it reverses; at which point, the trader would follow the new trend. The key to trend trading is knowing how to identify price trends, and spotting upcoming price reversals, and reacting accordingly.

Mean reversion

A mean reversion strategy hinges on the idea that prices eventually move back to the middle – i.e., revert to the historical mean. Thus, a trader using mean reversion would look for a currency pair which has differed considerably from its historical average. Once identified, the trader should prepare to take advantage of the return of the price to its average.

Money flows

In the money flows strategy, a trader attempts to decipher whether a currency pair is overbought or oversold by comparing trading volume from the previous day to the current day. Should the currency pair be found to be oversold, it might signal a buying opportunity. If the currency pair is found to be overbought, it might signal a selling opportunity.

Knowing how to use the right technical indicator to identify overbought/oversold conditions is required to potentially succeed with this strategy.

How to start day trading forex

Choose your preferred day trading method

There are many ways today to trade the forex market, so the first step is to choose your preferred method.

There are many ways today to trade the forex market, with CFDs being a popular choice. CFDs allow you to trade on margin, potentially increasing your buying power. Here at Vantage, we offer Contracts-for-Difference (CFDs) for the world’s most traded forex pairs, including USD/JPY, EUR/USD and GBP/JPY. Additionally, we offer CFDs for forex pairs featuring exotic currencies and those of emerging economies, providing forex traders with a deep selection of currency markets to execute their preferred strategies. It's important to understand that while CFDs can offer advantages like leverage and the ability to go short, they also come with increased risks.

Create a day trading plan

Day trading requires a disciplined approach, and a clear view of your goals and objectives. While this can help manage risk, it's crucial to understand that day trading can result in significant losses, so careful risk management is essential to protect your financial stability.

Thus, it is helpful to have a day trading plan that spells out your funds, trading strategy, position sizes, risk management techniques and other crucial factors. This will help you approach forex day trading with a grounded mindset.

Learn how to manage day trading risk

Crucially, forex day traders must learn how to manage day trading risk. The forex market can be volatile, with geopolitical and macroeconomic factors adding another layer of unpredictability. This requires day traders to have a good knowledge of risk management tools such as limits and stops.

A crucial part of risk management is learning how to control their risk-reward ratio. By focusing on a high risk-reward ratio above 2:1 (i.e., getting back twice the amount risked in the trade), a forex trader can build a greater margin of protection against losing trades. This can be more helpful than obsessing over a high win-loss ratio.

Open and monitor your first position

After going through the steps above, you are ready to start forex trading. You can go ahead and place your first position, after considering carefully which currency pair to trade, the strategy you will employ, how large your position will be, and your take-profit and stop-loss levels.

In general, you’ll buy or go long if you think the currency pair will go up. If you think the currency pair will go down instead, you’ll sell or go short.

Remember to monitor your position as the trade plays out, including scanning for news or developments that could impact your trade. This becomes increasingly important as you begin to make several trades throughout the day, as is expected of day traders.

As the trading day draws to a close, remember to close any positions remaining open. This is to avoid overnight fees.

Explore More About Forex Trading

-

What is Forex

Learn the basics of Forex trading, including how it works and why it’s a popular market for traders worldwide.

-

How to trade Forex

Discover step-by-step guidance on how to start trading Forex via CFDs, from opening an account to executing your first trade.

-

Why Trade Forex

Find out the unique benefits and advantages that trading forex can offer, and why any serious trader should consider this dynamic market.

Award-Winning Broker

-

Best Broker

AustraliaInternational Business Magazine

-

Best Customer

Support AustraliaInternational Business Magazine

-

Best Overall Broker –

AustraliaInternational Business Magazine

Trade AU Share CFDs On All Trading Platforms

MetaTrader4

- 30 built-in technical indicators

- 31 analytical charting tools

- 9 time-frames

- 4 types of trading orders

MetaTrader5

- 38 built-in technical indicators

- 44 analytical charting tools

- 21 time-frames

- 6 types of trading orders

TradingView

- 15+ chart types

- 100+ in-built indicators

- 50+ drawing tools

- 12 alert conditions

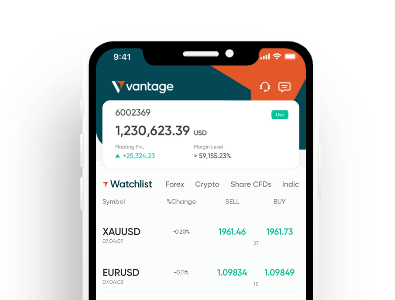

Vantage Mobile App

- 55 deposit methods globally

- 220+ daily product analysis

- 16 TradingView indicators

- 80,000+ copy traders

Choose a Trading Account Based on Your Experience Level

-

1

Beginner Traders

-

2

Experienced Traders

-

3

Professional Traders

High Volume Traders

- For traders looking for low and competitve commission, with only $1 per standard FX lot per side.

-

1

Register

Quick and easy account opening process.

-

2

Fund

Fund your trading account with an extensive choice of deposit methods.

-

3

Trade

Trade with spreads starting as low as 0.0 and gain access to over 1,000+ CFD products.

Frequently Asked Questions

-

1

Can I trade forex CFDs with $100?

Yes, you can start trading forex CFDs with as little as $100, though this depends on factors such as your broker, chosen strategy, and available leverage. Leverage enables you to manage larger positions with less capital, which can significantly amplify your potential profits. However, it also increases the risk of substantial losses, potentially exceeding your initial investment, so it's important to use it carefully. -

2

Is $500 enough to trade forex CFDs?

Yes, $500 is enough to start forex CFD trading. Vantage allows traders to begin with even smaller amounts—as little as $50. However, it's important to use proper risk management and choose appropriate leverage to trade safely. -

3

Is forex CFD trading a good idea?

Forex CFD trading can be suitable for traders with a high risk appetite interested in understanding market fundamentals. Vantage offers educational resources, including webinars and courses, designed to support new traders. Starting with a small amount of capital, regularly practising, and conducting thorough research can help traders gradually develop their skills and experience. -

4

What is forex CFD trading and how does it work?

Forex CFD trading involves buying and selling currency pairs to profit from changes in exchange rates. Brokers such as Vantage offer access to forex markets through CFDs (Contracts for Difference), enabling traders to speculate on price movements without owning the actual currencies. This allows traders to open both long and short positions while benefiting from real-time market data and advanced trading platforms. -

5

How much money do I need to start trading forex CFDs?

With Vantage, you can begin trading forex CFDs with as little as USD $50. However, the exact amount required will depend on factors such as the currency pairs traded, the leverage you choose, and your individual risk tolerance. -

6

Can I teach myself how to trade forex CFDs?

Yes, you can learn forex CFD trading independently by utilising educational resources such as articles, webinars, and tutorials. Vantage offers various learning materials to help you grasp market fundamentals, technical analysis, and trading strategies. Additionally, practising with a demo account can help build your confidence and experience before investing real money.

Disclaimer: The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.