Tech woes continue ahead of big risk events

* Dollar strengthens mildly, GBP lower on softer CPI

* Nvidia falls on news Amazon in talks about $10bn powerplay with OpenAI

* Oracle data centre plan hit as Blue Owl walks away from $10 billion deal

* Crude rebounds as Trumps’ Venezuelan blockade stokes uncertainty

FX: USD started the day strongly but came up against resistance as the 100-day SMA at 98.61. It then turned around with the index eking out marginal gains on the day. NFP was mixed and not a major game changer but still pointed to a softening job market outlook. There was also chatter about a higher BLS standard of error in the data. Debate around the next Fed Chair picked up with pushback against the previous top contender, Kevin Hassett, an official most in line with President Trump. The alternative, Warsh, has seen odds jump, but he is seen as more of a hawk and would probably help US yields and the dollar.

EUR outperformed its peers as markets eye the ECB meeting. A moderately hawkish hold is seen likely with updated staff economic projections supporting this stance, and the euro. Seasonals should also hurt the greenback as we move through December into year-end. Germany’s IFO business sentiment survey was modestly disappointing and hit the lowest level since May.

GBP got hit hard initially on softer than forecast CPI data. Notably, food and services inflation fell sharply which weighed on market expectations for the policy path next year. A second rate cut is now fully priced in by April. See below for more on the BoE meeting. The 200-day SMA sits at 1.3345 with the 100-day SMA just above at 1.3359. The recent top is 1.3455.

JPY was the major underperformer even on stronger trade data. Positioning could be playing a part as markets head into the BoJ rate hike on Friday. A higher rate path is expected into 2026 so all eyes are on Governor Ueda and guidance.

US stocks: The S&P 500 lost 1.16%, closing at 6,721. The Nasdaq moved lower by 1.93% to finish at 24,648. The Dow settled down by 0.47% at 47,886. Tech was the big underperformer with Communication and Industrials also lagging. Energy surged over 2.2% as a sector as crude rose over 3% driven by worsening US-Venezuela relations and potential new energy sanctions on Russia. Media report suggested that Oracle’s $ 190bln Michigan data centre deal is in limbo after funding talks with Blue Owl stalled. The shares still slid 5.4%. Chip names were weighed on (Nvidia -3.8%, AMD -5.3%) on Reuters reports that Chinese researchers completed a working prototype in early 2025 and are targeting 2028 for working chips. This adds more competition in the tech space and reducing the need for chips from US companies in China. Google is reportedly set to collaborate with Meta to expand software support for AI chips. Meanwhile, Micron forecast Q2 profit nearly double analyst expectations after the closing bell. He stock has jumped over 12%.

Asian stocks: Futures are mixed. APAC stocks were indecisive with the region lacking conviction following the uninspiring lead from Wall Street amid a deluge of mixed data releases. The ASX 200 was subdued as gains in the mining, materials and resources sectors were offset by weakness in energy, defensives and financials. The Nikkei 225 swung between gains and losses amid a choppy currency and better-than-expected Japanese machinery orders and exports data. The Hang Seng and Shanghai Comp initially traded indecisively in a narrow range with little fresh macro catalysts from China, though indices later climbed to session highs.

Gold moved higher with bullion potentially setting up for a bust through record highs. Precious and semi-industrials metals all surged as silver hit fresh highs, up an incredible 127% this year. Platinum hit a 14-year top and has added 116% year-to-date. Tight supply outlooks are helping, as well as demand for hard assets.

Day Ahead – US CPI, BoE & ECB Meetings

Headline US annual inflation is expected at 3.1% and core at 3%. There is no monthly figure due to the government shutdown. Falling services prices, specifically shelter, is predicted to offset some tariff-related goods inflation, though some economists warn of higher cost inputs like wages and energy. Recent Fed commentary signals limited concern over inflation, with Chair Powell last week pointing to easing price pressures, continued services disinflation and largely tariff-driven goods inflation. The latter is expected to peak in early 2026 before easing in the second half of next year.

The ECB is very likely to sit on its hands and keep the deposit rate at 2%. The eurozone economy has been broadly resilient in recent weeks with growth surprising to the upside, while wage growth and services inflation prove stickier than forecast. New growth projections may be revised higher with the medium-term inflation path broadly aligned with target. It all points to a quiet meeting, with policy still in a ‘good place’ and a data dependent stance with policy well-positioned.

The Bank of England will cut rates by 25bps, bringing the bank rate to 3.75%. Recent data has cemented this move with this week’s much softer than expected inflation figures helping the doves. Importantly, food and services inflation dipped with the former previously being a concern for the hawks and worries about persistent long-term inflation expectations. Tuesday’s jobs data was also weaker with wage growth falling below the Q4 BoE forecast. Markets see a reasonable chance of another cut by March or April should data continue to soften.

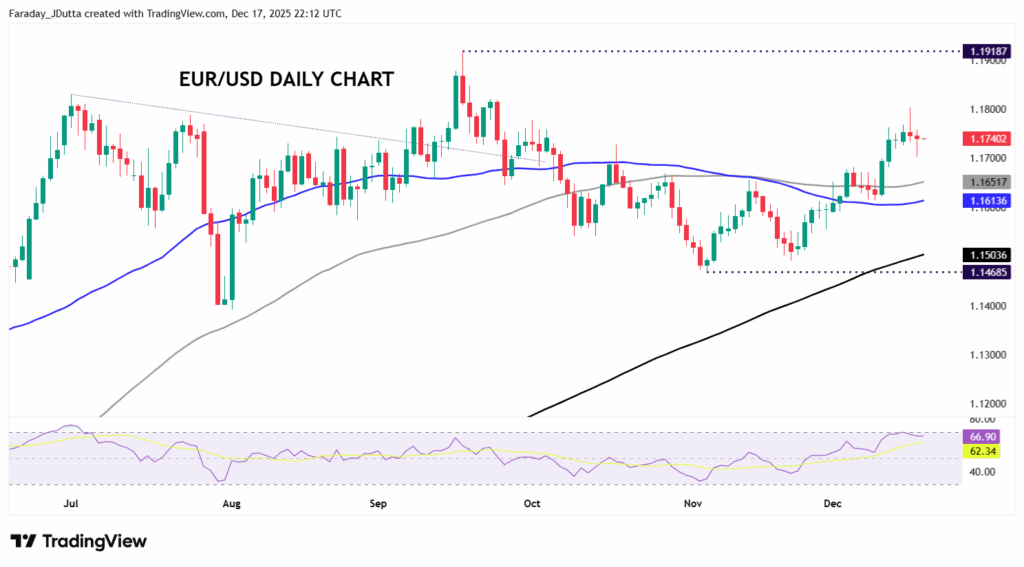

Chart of the Day – EUR/USD undecided into risk events

Since bottoming in early November at 1.1468, the world’s most popular currency pair has gradually moved higher, especially since the dip towards the end of that month. Prices broke above the 50-day and 100-day SMAs, now at 1.1613 and 1.1651. The latter push higher came after the more dovish than expected FOMC meeting, from a bullish consolidation pattern. But the major did print a shooting star on Tuesday, which could signal a potential bearish reversal. Prices were mildly overbought, though buyers stepped in yesterday, after the major slipped to 1.1703.