Stocks continue higher amid US payroll revisions

* Big NFP revisions make an even stronger case for rate cuts

* Dollar finds a bid after sharp sell-off ahead of inflation data

* All three major US stock markets make record closing highs

* Apple debuts iPhone 17 lineup, including skinniest Air model

FX: USD dropped to lows at 97.30 in the European session before turning around and snapping a two-day losing streak. The BLS’s preliminary payroll saw a bigger downward revision than expected at -911k versus a forecast -700k and prior -598k. Buyers stepped in as markets interestingly somewhat downplayed the report, given its backwards-looking nature (April 2024–March 2025), and the fact that the final report comes in February, alongside the January jobs report. That said, the bottom line is the US has a weaker labour market which adds to the downbeat outlook after Friday’s NFP report. PPI data is up next.

EUR gave back its earlier gains and closed on its lows just above 1.17, vying with CHF as the worst major performer. The single currency had looked good for more upside towards the multi-year high with eyes on a relatively hawkish ECB compared to the more dovish Fed. French President Macron is expected to appoint a new PM soon with political uncertainty remaining high.

GBP was bid until the release of the US BLS report, getting to a peak at 1.3590, a near 4-week high. Markets are breathing a sigh of relief over PM Starmer’s recent cabinet shuffle though the upcoming Autumn Budget looms large, scheduled for late November.

JPY was the outperformer as the major dipped to 146.30, a level last seen in mid-August. Below here sits the late July low at 145.85. Renewed confidence in the BoJ’s intentions for rate hikes drove the yen higher, with media reporting that policymakers are not deterred by the latest political uncertainty introduced by PM Ishiba’s upcoming resignation. The 200-day SMA is decent resistance at 148.71. Prices retraced back to the 50-day SMA at 147.41 negating the earlier bearish momentum for the time being. We are also watching major resistance in EUY/JPY at 174 and at 200 in GBP/JPY.

AUD outperformed most of its peers on the back of firmer iron ore prices. CAD lagged with the bid for the commodollars not helping much either. In fact, AUDCAD touched its highest level since late 2024. Upcoming Fed and BoC easing has hurt the loonie over the past month.

US stocks: The S&P 500 gained 0.27% to close at 6,513, a record high. The Nasdaq rose by 0.33% to settle at 23,840, a second straight record closing high. The Dow Jones finished at 45711, a record top, up 0.43%. Sectors were mixed with only Materials, Industrials and Real Estate in the red. Communications and Energy outperformed as the latter got a bump from Israel’s bombing of Qatar. Apple fell for a third day in a row and closed down 1.48%. It announced new watches, an iPhone and iPhone Air, and AirPods. Palantir jumped over 4% having found support and tracked sideways for a few weeks around its 50-day SMA at $157.55. A couple of positive Wall Street analyst reports were released citing the company’s profitable growth path and competitive advantage in turning data and AI into customer solutions.

Asian stocks: Futures are mixed. Stocks also traded mixed on Tuesday with few fresh catalysts ahead of US inflation data. The ASX 200 was dragged lower by energy, industrials and financials weakness with disappointing confidence and survey data not helping. The Nikkei 225 initially rallied to a new high above 44,000 before profit taking amid yen strength. The Hang Seng and Shanghai Comp were mixed with Hong Kong gaining on tech and real estate strength while the mainland lagged amid lingering global tensions.

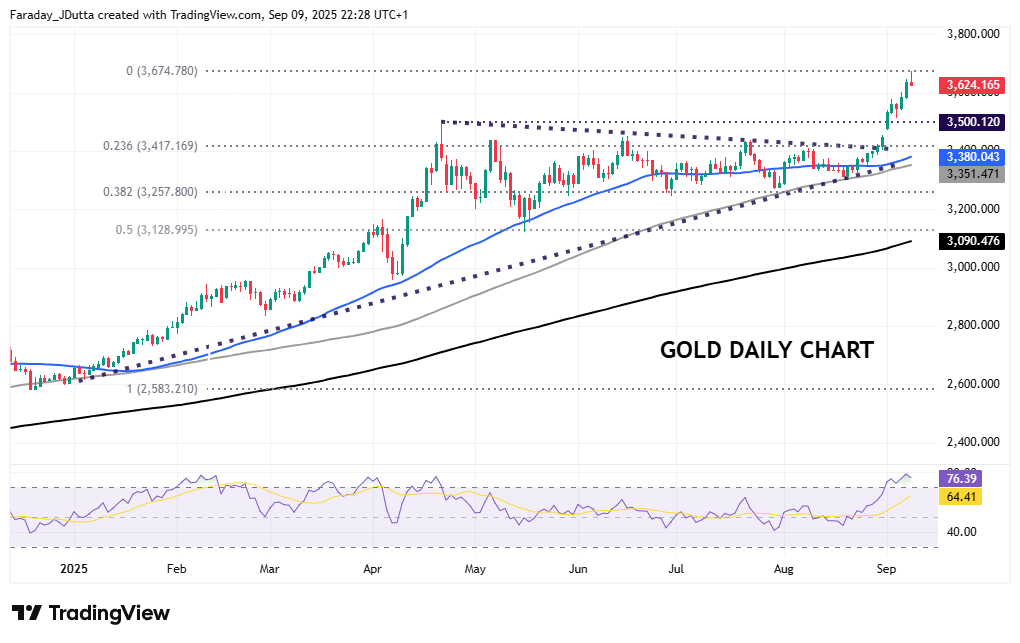

Gold’s upside breakout again powered onto new highs at $3,674as prices moved further into overbought territory. Prices turned as the dollar and yields found a bid. See below for more on gold’s record-breaking run.

Day Ahead – China CPI, US PPI

A negative, deflationary print is expected in Chinese CPI at -0.3%, after the flat reading in July. Falling food prices are forecast to offset a modest pick up in core inflation. More broadly, overcapacity is keeping consumer prices lower.

US PPI comes out this week ahead of CPI data, a rare occurrence. PPI is the cost of imported goods and essentially measures price changes before they reach consumers. Research suggests if both headline and core PPI are the same way (weak or strong), it’s a pretty decent predictor of both headline and core CPI. If they are mixed or as expected, there is no signal. There is also some mild positive seasonality in August. Certainly, a strong inflation number will bring thoughts of stagflation to the fore.

Chart of the Day – Gold rally overbought

Bullion looked like rising nine straight sessions in the last 10 after surging to another fresh record high, with prices up nearly 40% this year. But prices gave up gains and closed on their lows late yesterday. The precious metal has recently been supported by increased bets on more Fed rate cuts this year. Swap traders price in nearly three moves (68bps) in 2025 with a terminal rate closing in on 3% next year. Lower borrowing costs typically benefit precious metals as they do not pay interest. Monetary policy expectations are now likely to become the primary driver for gold’s direction. Continued concerns over the Fed’s independence will also remain the focus looking ahead, amid Trump’s aggressive trade policy, conflicts in the Middle East and Ukraine, and central bank buying.

We note a Goldman Sachs research note out last week that said gold could soar to $5,000 if Trump’s manipulation of the Fed undermines confidence in US markets. That would likely lead to higher inflation, lower stocks and an erosion of the dollar’s reserve currency status. For the near term, prices are heavily overbought on several measures.