If 2025 has taught us anything, it’s that the market doesn’t wait for perfection. It rallies on relief.

Every time the world braces for bad news, whether it is inflation jitters, tariff shocks, or political drama, investors find reasons to buy.

And somehow, it keeps working. The S&P 500 Index has continued to reach new record highs in recent months. Bears keep warning about stretched valuations, yet buyers keep showing up.

As we head into the final stretch of 2025, the message is clear: growth is slowing, not stalling. Inflation is cooling, not collapsing. And central banks, once the villains of the tightening cycle, are slowly turning into the heroes of the easing story.

The market’s wall of worry remains tall. But optimism, liquidity, and a little FOMO have been instrumental in helping the market climb higher.

Key Points

- Global markets are rallying on optimism and easing policies, even as growth slows and inflation remains uneven.

- Central banks are shifting from tightening to gradual rate cuts, boosting liquidity and supporting risk assets worldwide.

- Confidence continues to drive markets higher, but investors are urged to stay balanced and prepared for renewed volatility.

Beneath the Buzz: A Cooling Economy That Still Carries Heat

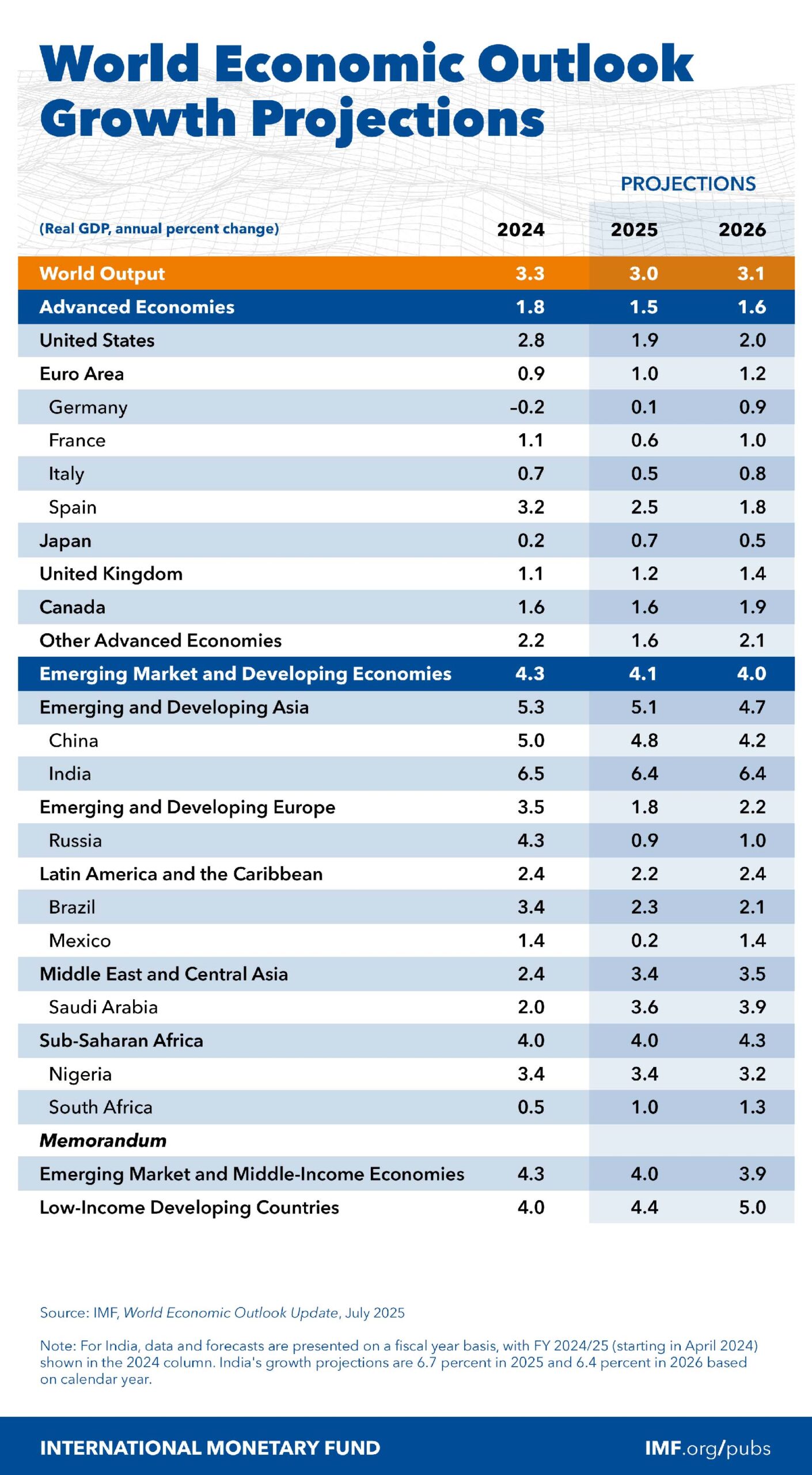

For all the optimism, the global backdrop isn’t roaring. It’s just resilient. The IMF expects global GDP to grow around 3% this year and 3.1% in 2026 [1].

That’s hardly explosive growth but it’s also far from crisis territory. Inflation has moderated, though unevenly, as supply chains heal and energy prices stabilise.

The real story, however, isn’t the data. It’s the direction. Central banks are no longer debating how high to hike; they’re asking how soon they can safely cut.

Liquidity is creeping back in, and that quiet shift is what keeps fueling risk appetite. Disinflation is fragile, yes, but it’s still progress. And in markets, direction often matters more than perfection.

From Fighting Inflation to Managing Expectations

The world’s major central banks are now singing a softer tune. They are not cutting rates recklessly, but they are easing the pressure valve.

| Central Bank | Current Stance (Q4 2025) | Key Signals | Market Implications |

| Federal Reserve | Shifted from “higher for longer”→ “cut with care” | Slower hiring, cooler inflation, tariff effects muted | Gradual rate cuts support risk assets; USD may soften |

| European Central Bank | Data-dependent and cautious | Likely one more cut by early 2026 | Eases pressure on EU equities and credit markets |

| Bank of Japan | Slow-moving normalization | Wages rising steadily | Weaker yen → foreign flows into global assets |

| People’s Bank of China | Targeted easing | Focus on industrial and green sectors | Stabilises growth without broad stimulus |

In short, here’s the key takeaway: while central banks are moving at different speeds, they’re all heading in the same direction (i.e. cuts, not hikes).

The tightening cycle is behind us. And for investors, that single shift in tone is all it takes to keep the rally alive.

After the Shocks, Resilience Becomes the Story

Remember April’s “Liberation Day” tariffs? Markets panicked and sold off. The S&P 500 Index plunged below 5,000, while headlines screamed “Trade War 2.0,” and sentiment turned sour. But within weeks, the sell-off faded as liquidity rushed back.

That episode defined 2025. It proved that when confidence and cash are still in the system, even big shocks can’t derail the trend for long.

And from there, the rally evolved. What began as an AI-driven surge has broadened into something deeper, with a shift towards a multi-engine recovery powered by industrials, financials, and consumer names.

This isn’t just about chips and data centres anymore. It’s now evolved into a narrative about capital spending, productivity, and policy momentum – all working in sync.

The Rally Finds New Legs Around the World

For much of the post-pandemic era, investors were told there was no alternative to US markets. The “Magnificent 7” dominated headlines, American earnings drove global sentiment, and every correction abroad was met with “just buy the dip.”

But 2025 is quietly rewriting that story. Global money is moving again, and this time, it’s moving beyond Wall Street. Nearly US$100 billion has flowed into Asia ex-China markets this year, marking one of the largest reallocation waves in a decade [2].

Here’s a look at the snapshot of the growth drivers in these different markets:

| Region | Primary Theme | 2025 Performance Drivers | Outlook (Q4 → 2026) |

| United States | AI & productivity boom | Earnings resilience + liquidity | Moderate growth; valuations stretched |

| Japan | Corporate governance reform | ROE targets ↑ + weaker yen | Sustained inflows & rotation into value |

| India | China+1 manufacturing story | FDI, digital & renewables | Strong structural growth |

| Korea / Taiwan | Semiconductor super-cycle | AI chips, export momentum | Valuations still reasonable |

| China | Targeted stimulus & stabilisation | Support for industrials & green energy | Gradual recovery; not a V-shape rebound |

| ASEAN | Reshoring + infrastructure | Singapore finance hub, Malaysia data centres | Resilient mid-cycle growth |

| Europe / UK | Industrial rebound & weak currency boost | Lower energy costs + export lift | Steady rotation trade potential |

The bottom line? The era of US exceptionalism, where Wall Street led and the world followed, is starting to fade. The rally now has multiple engines, powered by reforms in Japan, manufacturing in India, semiconductors in Korea and Taiwan, and resilience in ASEAN and Europe.

This is no longer a one-country show. It’s a global ensemble, and the music is finally playing in harmony.

Calm Currents, Hidden Ripples: What’s Beneath the Market’s Surface

At first glance, the macro backdrop looks almost too calm. Real yields are drifting lower, not plunging, but gliding just enough to lift equity valuations and ease financing costs.

If the Federal Reserve leads the global rate-cut cycle, the US Dollar could soften, giving emerging markets and commodities some long-awaited breathing space.

Oil prices have stayed range-bound as OPEC+ fine-tunes production, keeping inflation worries contained without choking growth.

Gold continues to shine quietly (and set new highs) as investors hedge against geopolitical shocks, while copper and other transition metals draw strength from the long-term pull of green infrastructure and AI-driven demand.

These steady, almost invisible forces are the reason markets keep humming even when headlines flash red. But beneath that calm lies something subtler, a market that may be getting too comfortable. The Bloomberg Intelligence Market Pulse Index has hovered in “manic” territory for two straight months, echoing the euphoria of the late-1990s tech boom.

The index measures market breadth, correlations, and momentum. In other words, how widely and aggressively investors are buying. A reading near “1” signals extreme risk-on sentiment, and “manic” territory often comes before short bursts of volatility.

Importantly, this didn’t happen overnight. The index has been climbing all year as optimism spread beyond mega-caps, reflecting a rally that has broadened and heated up.

So far, every dip has been met with buyers. Liquidity is abundant, central banks are leaning dovish, and investors have been conditioned to treat volatility as an opportunity. But that very confidence can breed both inertia and surprise, whether from renewed tariff tensions, an energy spike, or slower growth abroad.

In short, the backdrop looks calm but the warning light is flashing yellow. A “manic” reading isn’t a sell signal itself but it’s a timely reminder to fasten your seatbelt.

The Q4 Playbook: Stay informed, stay balanced

You don’t need to call the top to invest smart. You just need to monitor the trend with discipline. Quality still leads the charge. Investors often monitor companies that demonstrate the ability to monetise AI and maintain consistent earnings strength.

Cyclicals sectors such as industrials, logistics, and financials have generally benefited from policy easing so far in 2025, while dividend stocks and utilities remain your quiet anchors when volatility returns.

Regionally, Asia ex-China, Japan, and ASEAN are no longer niche; they’re the new growth engines of global portfolios. As the year winds down, keep an eye on a few signposts.

- IMF World Economic Outlook (October): Watch for updates on global growth and tariff impact assumptions; a benign read reinforces the “slow-ease” rally narrative.

- ECB guidance and German bund yields: Any hint of calendar-based easing could extend Europe’s rotation trade.

- OPEC+ decisions and weekly crude data: Stability here gives global equities breathing room to focus on earnings rather than inflation fears.

- Fund flows into Asia and Japan: Confirmation of sustained inflows would validate the diversification theme taking hold.

- Sentiment gauges like the VIX and Bloomberg’s Market Pulse Index: Too much euphoria can precede air pockets, but so far the market has handled exuberance well.

For now, the rally’s cadence continues. The S&P 500 Index keeps setting records, investors keep chasing, and short-sellers keep feeling major regret.

Optimism still pays, but the tank isn’t infinite. The best investors in the final quarter of 2025 will be those who stay offensive yet balanced, capturing upside with one hand, and holding a safety net with the other.

From Strategy to Execution: Key Market Themes for Q4 2025

The outlook sets the direction but execution determines results. After a year of resilience and relief rallies, investors now face a familiar challenge in Q4 2025: staying invested without overreaching.

We all know that ETFs have quietly become the backbone of modern investing, helping investors move from ideas to action. Global ETF assets have surged past US$16 trillion in 2025, with Asia-Pacific alone hitting a record US$1.4 trillion [3].

This rise isn’t just about convenience. It’s about control. ETFs give investors the flexibility to stay diversified, adjust exposure quickly, and turn strategy into execution without needing to pick individual stocks.

Balanced portfolios have historically been more resilient in similar market conditions.

Broad index ETFs remain the foundation, offering low-cost access to markets and the power of compounding. Around that core, investors can layer tactical ideas to reflect today’s realities: easing policy, uneven regional growth, and a still-optimistic market that occasionally needs grounding.

| Portfolio Layer | Positioning Approach | Purpose |

| Core Exposure | Use broad market or regional ETFs to stay aligned with long-term growth. | Forms the base of diversification and stability. |

| Growth Opportunities | Add selective exposure to themes such as AI, clean energy, and infrastructure. | Captures areas driving productivity and capital spending. |

| Income & Stability | Include dividend or quality-focused equities and short-duration bond exposure. | Provides steady returns and cushions volatility. |

| Defensive Anchors | Maintain some allocation to gold, transition metals, or defensive sectors. | Serves as a hedge against inflation and sudden shocks. |

Execution in the final three months of the year is about staying constructive, not complacent. Keep your foundation broad, your tilts intentional, and your defenses ready.

The goal isn’t to time the next correction. It’s to stay invested through it, balancing conviction with caution as the market writes the final chapter of 2025.

Confidence Carries but Caution Counts

As 2025 heads into its final stretch, markets remain driven by confidence, liquidity, and belief in a soft landing. Growth is slowing but steady, inflation is easing, and central banks are turning supportive, enough to keep the rally alive, even as valuations stretch.

But momentum alone won’t sustain this market. The next leg will reward investors who stay balanced, not bold, anchored by discipline, diversified through ETFs, and ready to adapt when sentiment shifts. Optimism still pays, but prudence keeps you in the game.

Reference

- “Global growth expected to decelerate as trade-related distortions wane – International Monetary Fund”. https://www.imf.org/en/Publications/WEO/Issues/2025/07/29/world-economic-outlook-update-july-2025 . Accessed 8 Oct 2025.

- “Asia draws $100 billion in capital as investors diversify beyond US, Goldman executive says – Reuters”. https://www.reuters.com/markets/wealth/asia-draws-100-billion-capital-investors-diversify-beyond-us-goldman-executive-2025-10-01/ . Accessed 8 Oct 2025.

- “ETFGI reports that assets invested in the ETFs industry globally reached a new record of US$16.99 trillion at the end of June – ETFGI”. https://etfgi.com/news/press-releases/2025/07/etfgi-reports-assets-invested-etfs-industry-globally-reached-new-record . Accessed 8 Oct 2025.