Markets remain choppy on Fed and US-China relations

* Wall Street advances on strong bank earnings in volatile session

* Gold through $4,200 on Fed rate cut signals and trade tensions

* Dollar softens amid ongoing US-China trade frictions

* LVMH shares surge after surprising return to sales growth on China demand

FX: USD fell once the US session kicked off with some focus on Fed comments as well as the current (TACO) US-China trade war noise. The WSJ reported overnight that China is betting a hit on the US stock market will cause Trump to cave in negotiations. Chair Powell nod through another 25bps rate cut on October 29 with his recent comments. He said the economic outlook was largely unchanged since the September meeting, highlighting growing labour market risks. The absence of data further likely makes things more challenging in October releases. Improved risk sentiment also saw more dollar selling. The January FOMC meeting is now a coin flip for a third 25bps rate cut, after two moves priced in October and December.

EUR rose for a second straight day, the first time in two weeks, and closed around the 100-day SMA at 1.1641 and a major Fib level of the August to September move at 1.1592. French/German bond spreads have continued to narrow as markets breathe a sigh of relief over French PM Lecornu’s successful negotiations with the Socialist Party who have said it will not oust him ahead of today’s no confidence vote. The 50-day SMA sits above at 1.1690.

GBP outperformed as it continued to claw back losses after spiking down to 1.3248 on Tuesday on the dovish UK jobs report. BoE Governor also highlighted the softness and UK-US spreads have pulled back as a rate cut gets priced in by February. Chancellor Reeves was reported to be reviving plans to overhaul domestic savings products (tax-free ISAs) in an effort to divert billions of savings from cash into domestic stocks, while strongly hinting that higher taxes on the wealthy ‘will be part of the story’ at the November Budget.

JPY fell for a second day as it moved down below a major long-term fib level (61.8%) of this year’s January to April drop at 151.61. We note the big bearish ‘outside day’ from last Friday. Dovish repricing of the Fed is narrowing spreads with the yen so offering some support. LDP leader Takaichi asked Innovation Party leaders for their support in a premiership vote and coalition.

AUD pushed up above 0.65 on the better risk mood. RBA Assistant Governor Hunter said Q3 inflation was likely to be stronger than expected. Focus turns to today’s jobs report – see below for more. CAD struggled along with the dollar against its peers. The Tuesday spike high at 1.4080 looks like a bearish ‘shooting star’ candlestick.

US stocks: The S&P 500 added 0.4% to close at 6,672. The Nasdaq moved higher by 0.68% to settle at 24,745. The Dow Jones finished at 46,253, down 0.04% on the day. Real Estate, Utilities and Communication Services all outperformed closing over 1% higher, while Materials and Industrials were the big laggards, both off close to 0.5%. Regarding earnings, Morgan Stanley and Bank of America jumped on better results due to dealmaking strength. The former hit a record high as bank results more broadly signal a positive indication on US consumer strength. Chip stocks also rose as ASML reported orders and income better than expectations. AMD surged over 9% on a broker upgrade citing strong GPU traction and growth outlook. But Nvidia underperformed (-0.11%) on reports that Anthropic updated its smallest AI model, which is much cheaper than its more expensive models, and performs as well or better. The news revived fears that tech names could be overpaying for AI chips from Nvidia and the power needed may not be as much as initially thought.

Asian stocks: Futures are mixed. Stocks traded broadly higher as more Fed rate cuts offset the ongoing US-China trade ructions. The ASX 200 was helped by financials, healthcare and materials. The Nikkei 225 pushed up above 47,000 again as it overlooked a stronger yen and continued domestic political uncertainty. The Hang Seng and Shanghai Comp were more muted than their neighbours as traders digested the softer than expected inflation data and more trade war headlines.

Gold crossed the $4,200 level for the first time in its history, making a fresh high at $4,218. Falling Treasury yields and the increased trade frictions are helping. The longer-term debasement theme also remains alive and well. This narrative centres around investors feeling cash amid concerns over persistent government deficits, weakening central bank independence and rising inflation expectations.

Day Ahead – Australia Jobs

Australia releases September jobs data today, with consensus expecting a 20k rise in employment, a modest recovery after August’s 5k drop. Annual jobs growth has slowed to 1.5% from 3.5% at the start of 2025.The unemployment rate is seen ticking up one-tenth to 4.3%, which is still low by historical standards and unlikely to concern the RBA, unless we see another weak print or a sharper rise in joblessness. For now, the focus remains on inflation, with third quarter CPI due at the end of the month on 29 October.

Otherwise, a whole bunch of US data points like retail sales and initial jobless claims will not be relased due to the government shutdown. There should be more Fedspeak from Waller, Miran and Bowman, all President Trump appointees and all doves who voted for at least two more rate cuts this year. Fed pricing is relatively steady with just under 50bps priced in for the last two remaining FOMC meetings at the end of October and middle of December.

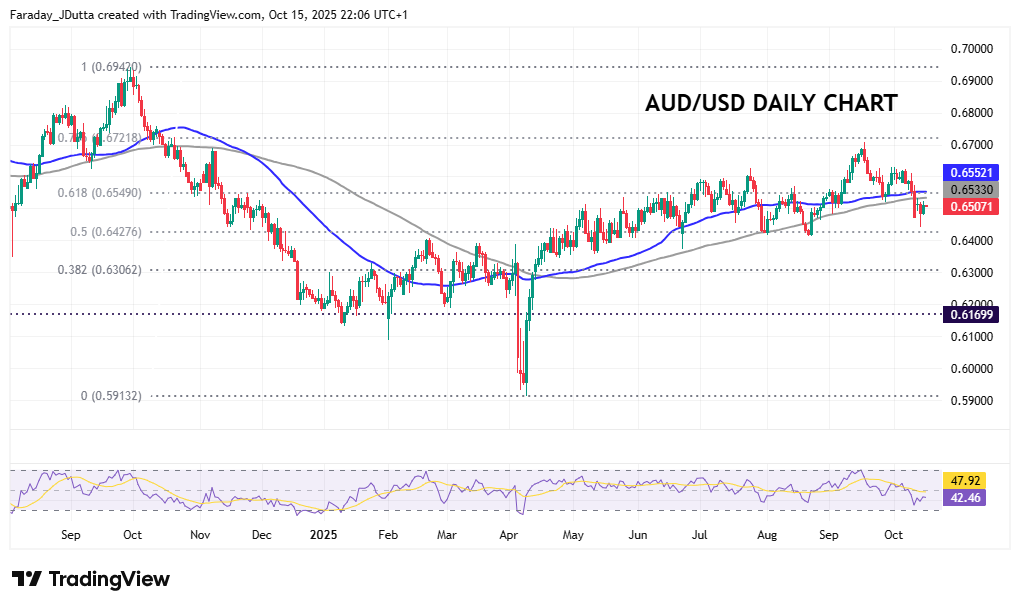

Chart of the Day – AUD/USD tries to retrace

The aussie sold-off sharply last Friday as it remains highly correlated to US-China trade headlines, given its status as the most China-sensitive G10 currency. Near-term, any further ramping up in trade tensions would see another move lower, with the midpoint of the September ’24 to April ’25 decline at 0.6427 acting as support. This is just below the spike low from Tuesday, so reinforces this short-term support area.

Better risk sentiment means the aussies’ high beta to global risk, along with commodity exposure and also its link to the debasement trade should help support buyers. The latter is a major current market theme with AUD’s strong correlation with inflation breakevens, a key measure of inflation expectations, potentially also boosting bulls. A conciliatory Trump-Xi meeting at the end of October could also see more upside. The 100-day and 50-day SMAs are 0.6532 and 0.6552 with the mid-September top at 0.6707.