Stocks spooked as valuation worries continue

* Wall Street lower ahead of Nvidia results and data deluge

* Dollar marginally firmer as markets await return of data

* Bitcoin erases all 2025 gains after $600bn fall

* Markets see a near 60% chance of the Fed sitting on their hands in December

FX: USD was firmer in pivotal week for the greenback. The government reopening means we get data releases, with September NFP taking centre stage. That said, it is a few months old but it will give us a steer towards how the labour market softness is unfolding. Odds for a December Fed rate cut have dipped below 50:50 to 40% for a move. That was double that less than one month ago. The Dollar Index has found support on the near-term upward trendline from the late September low. The 200-day SMA capped the upside recently, and that comes in currently at 100.03, above a long-term swing low from 2023 at 99.57.

EUR moved lower for a second day in a row even though interest rate differentials are nearing three-month highs. The dollar is the main driver ahead of the FOMC minutes and NFP release later this week. The ECB is in neutral mode and a ‘happy place’ regarding policy. The main data point this week are Friday’s PMI figures.

GBP outperformed as cable printed an inside day doji denoting some uncertainty. That isn’t surprising considering the huge amount of speculation and headlines we have seen pre-November 26 Budget. Sterling is getting some support as rate differentials have narrowed in recent days. Data comes thick and fast this week with CPI on Wednesday, and retail sales and PMIs on Friday. There’s currently around a 79% chance of a 25bps BoE rate cut next month.

JPY was the major underperformer as USD/JPY broke to the upside above 155. Better than expected Japan GDP was no help as investors wait for CPI published on Friday to determine if BoJ rate hike odds should increase from around 30% at present. Likely jawboning against the speed of the currency move may come from MoF officials.

CAD saw slight two-way trade on the latest inflation data. It was mixed as headline inflation Y/Y eased but was slightly above consensus. Core inflation picked up in October partially due to one-off factors.

US stocks: The S&P 500 lost 0.91%, closing at 6,672. The Nasdaq moved lower by 0.83% to settle at 24,800. The Dow Jones finished at 46,590, down 1.18% on the day. All but two sectors were negative with only Communication Services and Utilities in the green. Financials, Energy, Materials and Tech lagged, all down by more than 1.4%. Big Tech was broadly lower with Alphabet closing 3.1% higher on the back of Berkshire Hathaway of Warren Buffett fame, buying up nearly $5bn in stock in Q3. This was likely one of the last major investments with the Sage of Omaha at the helm and is a rare foray into AI. Apple is said to be speeding up the CEO succession planning as Tim Cook could step down as early as next year. The stock closed 1.8% lower. High valuation concerns continue to spook investors with all three major stock indices finishing below their 50-day SMAs.

Asian stocks: Futures are mixed. Stocks traded mostly lower after weekend news that President Trump won’t be rolling back any tariffs. The ASX 200 was muted again with tech and energy outperforming and telecoms and health lagging. The Nikkei 225 was choppy as it dipped under 50k before paring losses. GDP contracted for the first time in six quarters. Tensions between China and Japan also saw travel related names hit as Beijing warned citizens not to travel and study in Japan. The Hang Seng and Shanghai Composite were modestly lower on mixed trade news and Bessent optimism that a rare earths deal will be reached by Thanksgiving.

Gold fell for a third straight day as Fed rate cut bets diminished for the December FOMC meeting. There’s now only a 40% chance of a 25bps move next month, versus over 90% one month ago.

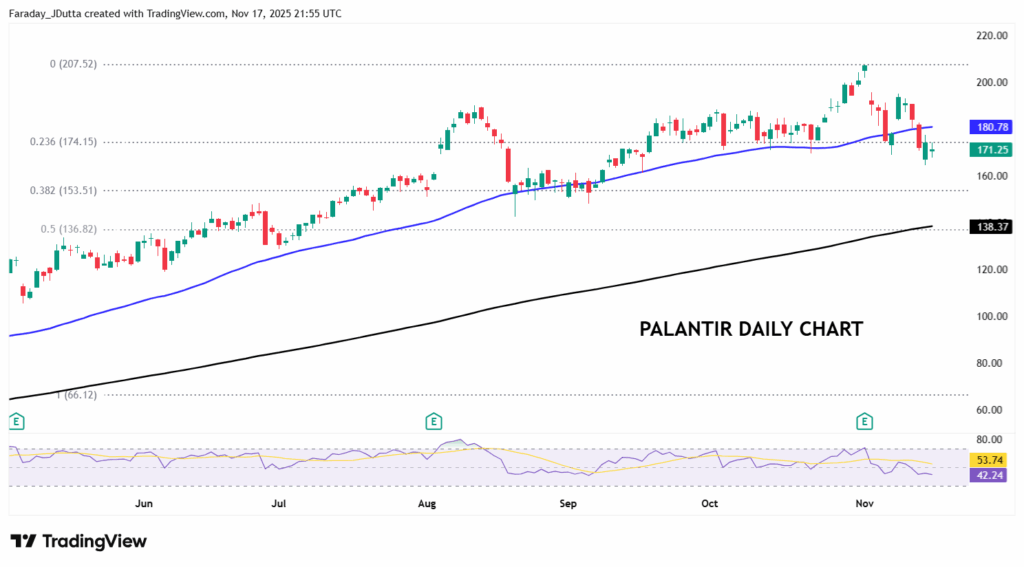

Chart of the Day – Palantir pulls back

Palantir slid 7% after its earnings at the start of the month, though that barely dented gains of more than 125% year-to-date. Enterprise AI names priced for perfection and stretched valuations have come under big pressure recently as investors now focus on ‘jam today’, and not tomorrow. The recent record high just before the release of its results was $207.52. Prices fell but found support around the minor Fib level (23.6%) of the April to November rally at $174.15. The 50-day SMA sits at $180.78. The major Fib level below (38.2%) resides at $153.51.