Weekly Outlook | More Important Data To Follow This Week

Important events this week:

Also, this trading week will offer an array of important data, which might continue to move markets. Last week’s rate cut by the FED caused the Dollar to weaken further. Stock markets on the other hand strengthened slightly but lost momentum during trading on Friday. In particular the Nasdaq technology index went lower indicating that the demand for AI- related stocks like Nvidia weakened causing the index being reactive.

Furthermore, also oil prices went lower, potentially indicating that the demand is losing some steam and also silver prices corrected slightly during late trading on Friday last week.

The delayed Nonfarm payrolls report, which is expected to be released on Tuesday this week might also move markets. While the last released offered 119.000 newly created jobs, this week’s release is expected to only show 50.000 new positions.

– US- Nonfarm payrolls report- The delayed NFP report is expected to show that 50.000 jobs had been added to the US economy. The shrinking of the US economy currently causes the Federal Reserve Bank to react and hence cut interest rates. It has been the third consecutive meeting where a 25-basis points rate cut had been applied. The Dollar is hence losing momentum and this might also be the case with the news release.

A weaker reading might continue to pressure the FED, which might continue with their path of reducing interest rates in 2026. Currently, market participants expect that just one rate cut will follow next year but weaker data might suggest a more dovish tone of Jerome Powell.

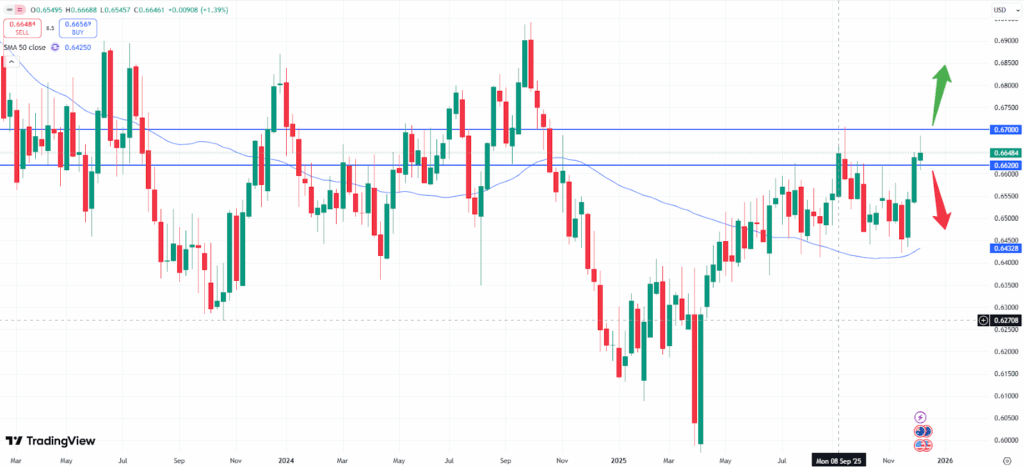

The AUDUSD is in particular interesting as it currently shows a strong uptrend. However, based on the weekly chart the market currently sits at a strong resistance level, which might not break for now. A break below the technical zone of 0.6620 might unleash fresh downside momentum. A better reading of the report might support such move. The uptrend of the pair might only continue above the 0.6700 zone, where the current resistance level from last week can be found. The data is expected to be released on Tuesday, 16th November at 14:30 CET.

– UK- interest rate decision- The rate decision of the Bank of England is expected to offer a rate cut by 25 basis points. The last rate cut had been implemented in August and recent economic data is suggesting that the Bank will reduce rates again during their meeting this week. It is also important to focus on how many members of the Bank will have voted for such move. The more members voting for a rate cut will show the general dovishness of the interest rate decision.

A closer look at the weekly chart shows, that the market is currently trading at an important resistance level. Only if the zone of 1.3430 can break, more upside momentum might be seen. The price might then target the 1.3700 trading range. A more hawkish cut (e.g. less members voting for a rate cut) might offer guidance here. The rate decision will be held on Thursday, 18th December at 13:00 CET.