All eyes on NFP as Treasury yields and dollar slide

* More Dow Jones record highs and more sector rotations

* Dollar softens after weak Retail Sales as yen rally continues

* Fed officials say no need for rate cuts and could be on hold for ‘some time’

* US monthly jobs report expected to stay solid, 70k headline forecast

FX: USD dipped for a third day though buyers stepped in after data and a low print of 96.60. Retail Sales underwhelmed, with the headline unexpectedly showing no growth in December despite expectations of +0.4%, while the core Control metric declined 0.1%. Treasury yields slid with the 10-year below the 50-day SMA at 4.17%. There’s now around 58bps of Fed rate cuts priced in with a first quarter point move predicted by June. Kevin Hassett, chair of the National Economic Council, suggested that the market should ‘not panic’ over lower jobs numbers. Markets took this to mean that US January NFP data could be disappointing. See below for more detail.

EUR steadied after its big move on Monday as prices stopped just short of the September cycle high at 1.1918. The late January top resides at 1.2082. ECB Vice President Guindos implied that the 1.16-1.18 level was consistent with the ECB forecast. All eyes are on today’s US jobs report.

GBP was the major laggard as cable struggled around the September highs. Domestic politics is still a lingering theme even though PM Starmer’s short-term position was shored up yesterday after his performance in front of his MPs. A by-election looms large and then the May local elections which currently will make for grim Labour headlines, losses and then a potential leadership stepdown or challenge, unless the polls improve for the incumbents. Betting markets currently see around a 54% chance that Starmer leaves office by June. US-UK rate differentials appear to have found a floor post last week’s dovish BoE, which should offer sterling some support. The next 25bps rate cut is now fully priced for April.

JPY gained big for a second day, outperforming its peers as prices touched the 100-day SMA at 154.39. PM Takaichi’s landslide election win has sparked bets on quicker BoJ policy normalisation which is boosting the yen. A strengthened mandate means fiscal expansion, but markets are taking a half-full view of the currency, with fiscal credibility front and centre. We are watching JGB yields and the bond price retreat which is the best gauge for judging market relief. The next bull target is the late January lows around 152.14/09.

US stocks: S&P 500 lost 0.33% to close at 6,942, the Nasdaq was off 0.56% at 25,128 and the Dow Jones was higher by 0.1% at 50,188, another fresh record high though the index closed well off its highs. Mixed sector performance with Utilities, Real Estate and Materials leading the gains, while Communication Services and Financials were the underperformers. There was further weakness in Alphabet and weakness in Charles Schwab and Interactive Brokers, with the latter possibly impacted by AI tax planning being added to an Altruist platform. DataDog surged 11% after its revenue and operating income beat, that helped support other software names, although its guidance was weak.

Asian stocks: Futures are mixed. APAC stocks were mostly higher after gains on Wall Street, and record Dow highs. The ASX 200 marginally gained amid continued outperformance in tech, but underperformance was seen in the top-weighted financial sector and weakness in some defensives. The Nikkei 225 rallied to a fresh record high near 58,000 amid the Takaichi trade and expectations of incoming stimulus. SoftBank was among the biggest gainers due to its heavy semiconductor exposure. The Hang Seng and Shanghai Comp lagged in somewhat mixed trade, with Hong Kong led higher by pharmaceuticals, but the mainland was flat.

Gold printed a rare ‘inside day’ in a narrow trading day as prices consolidated just above $5,000. Focus is on the data, amid recent position adjustments.

Day Ahead – US Non-Farm Payrolls

Consensus expects 70k jobs to be added in January, above the prior 50k. The 3-month average is 22k. The unemployment rate is predicted to remain at 4.4%. Wage growth is seen steady at 0.3% m/m and 3.75 y/y. Other recent labour market gauges have been mixed with job openings showing a sharp drop off which points to softer wage growth later in the year. The ISM services employment reported a second consecutive print above 50, indicating expansion after six months of contraction, while ISM manufacturing reported the slowest pace of job losses for 12 months.

Benchmark revisions will also be important for markets and could make for bleak reading. The revisions are where the Bureau for Labor Statistics (BLS) realigns their sample-based employment estimates with unemployment insurance population counts. A preliminary overestimate of 911k (roughly 76k per month) was seen for March 2025 and released last September, though Chair Powell recently suggested the overestimate is around 60k per month, so a 720k annual figure.

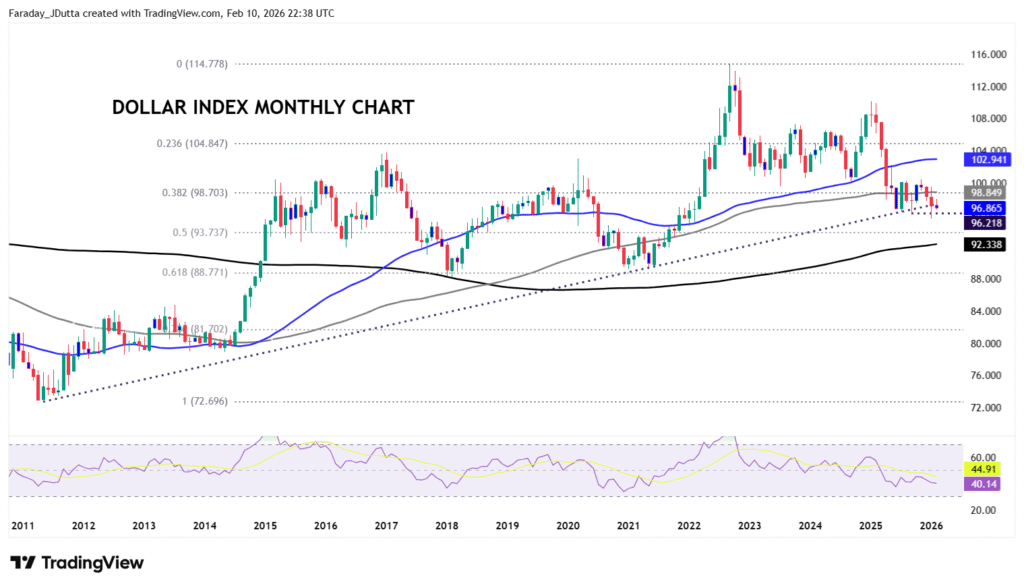

Chart of the Day – USD lower into data

While the yen has hit the Dollar Index this week, all eyes are now on this week’s top tier data with NFP first up today.Importantly, the January FOMC statement removed the line that “downside risks to employment rose in recent months” while suggesting that there have been “some signs of stabilisation” in the unemployment rate. But many economists disagree with this assessment, as just three sectors are providing the bulk of job gains in the last year or so. Without these, there would have been job losses. US Treasury yields have turned lower this week following last week’s other soft job market figures. Fed rate cut bets have increased with more than two 25bps moves now priced in for 2026. The DXY is trading between a long-term bullish trendline and the cycle lows from September 2025 at 96.21. The recent near-4-year low is at 95.55 with the next big retracement level below at 93.73. Long-term topside levels sit at 98.70 and 98.84.