Two-way price action before and after strong(ish) NFP

* Strong jobs report likely to keep Fed on hold for a while longer

* USD steady after choppy price action, AUD outperforms on RBA comments

* US stocks flat on payrolls surprise, UK’s FTSE 100 posts more record highs

* Fed official warns against rate cuts amid “hot” inflation

FX: USD was whippy with an intraday top at 97.27 made on the release of the stronger than expected monthly jobs data. But the index printed a doji with prices settling very near the middle of a wide range day. The headline at 130k smashed the consensus 65k estimate with only very minor revisions to the prior two months, while the jobless rate came in one-tenth lower at 4.3% and wage growth one-tenth higher at 0.4% m/m. That said, aside from three sectors (government, leisure, education and healthcare) the economy has actually lost jobs in recent months. The benchmark revisions were also grim as predicted, down 862k so above Fed Chair Powell’s 60k per month expectation. Rate cut bets did shift, with the next fully priced 25bps now seen in July, rather than June ahead of the data, though there’s still 51bps priced in for 2026.

EUR stalled at the September cycle high at 1.1918. The late January top resides at 1.2082. Sentiment is the current theme with central bank policy offering mild support to the ECB, even with yesterday’s stronger US jobs data. The outperformer of the year, CHF, was dented by the NFP figures as the dollar climbed for a third straight day.

GBP was mid-pack with sterling eking out a small loss versus the dollar. An easing in political uncertainty helped, though hurdles loom for PM Starmer to negotiate. Q4 GDP is released today with April rate cut odds high.

JPY gained big for a third straight day, outperforming its peers again as prices fell sharply below the 100-day SMA at 154.50. The relief rally post Sunday’s election from the stability and credibility message from Takaichi is still boosting the yen. JGB yields are steady and the bull target is the late January lows around 152.14/09. The 200-day SMA is well below at 150.41.

AUD made fresh near 4-year cycle highs at 0.7143 after supportive comments from RBA Deputy Governor who said…“many parts of the economy are doing quite well.” Prices are overbought on the weekly chart.

US stocks: S&P 500 was flat and closes at 6,941, the Nasdaq was up 0.29% at 25,201 and the Dow Jones was lower by 0.13% at 50,121. There was mixed sector performance with Energy, Consumer Staples and Materials leading the gains, while Financials and Communication Services were again the underperformers, with Consumer Discretionary the only other sector in the red. Energy stocks tracked crude prices higher, while financials were weighed on continued AI disruption concerns. Shopify saw a top line beat and buyback, opened sharply higher before closing down 6.7%. Robin Hood lost 8.9% as revenue came in short with both crypto and options trading revenue light. Ford beat on revenue and guided stronger profits in 2026 highlighting better cost controls; the share settled 2% higher.

Asian stocks: Futures are mixed. APAC stocks traded higher, but gains were capped after the weak US handover ahead of NFP. Liquidity was thin due to a Japanese market holiday. The ASX 200 outperformed with the index led higher by the top-weighted financial sector. Australia’s biggest lender and company by market cap, CBA, rallied following a 5% increase in first half profits. The Hang Seng and Shanghai Comp were kept afloat following the PBoC’s recent pledge to continue implementing an appropriately loose monetary policy However, upside was limited on the mixed Chinese inflation data.

Gold ticked higher with the intraday top at $5,119 made just before the NFP release. Prices moved off their highs but momentum is mildly bullish for more gains and two steady days of gains.

Day Ahead – UK GDP

UK Q4 GDP is expected at 0.1% q/q and 1.3% y/y, while December growth is forecast to rise 0.3% from 0.1%. The restart of car production at Jaguar Land Rover boosted Q4 but now means a softer December print as that impact eases. Solid growth momentum should carry over into 2026 in the UK even though there is subdued sentiment amid loud political noise around PM Starmer’s position.

Regarding the BoE, policymakers are struggling to determine the extent of additional easing required, with a divided MPC. Last week’s dovish hold and surprise tight 5-4 vote split versus a consensus 7-2, brought forward expectations for a 25bps cut to April. However, the likelihood of an additional cut remains short of its January highs with markets currently only pricing about 20bpts of additional easing for 2026.

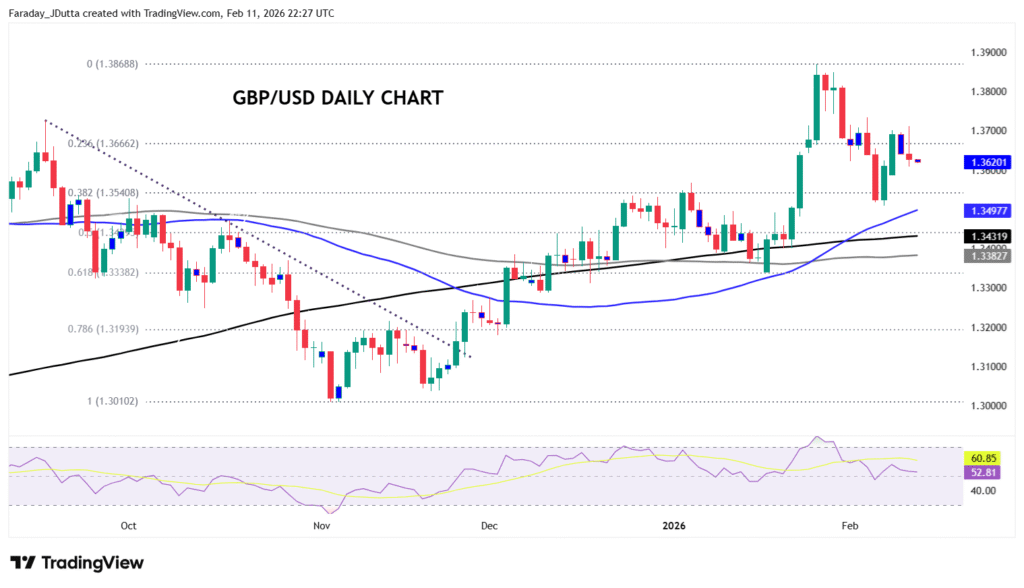

Chart of the Day – GBP/USD struggling to go higher

After pushing decisively in late January above the 200-day SMA, now at 1.3430, cable hit multi-year highs at 1.3868 with four strong days of buying as the dollar spiked lower. Prices then corrected through the minor Fib retracement level before finding support at the more important 38.2% Fib at 1.3540. Buyers stepped in here and the daily RSI ticked up higher from 50 denoting some bullish momentum. The major has now stalled up at the minor Fib in a near-term range between 1.3620 and 1.3730.