Gold’s relentless ascent reached a new symbolic high in mid-October 2025. First, it burst through the US$4,000 per ounce level and then breached US$4,200 [1].

The move itself captured a moment of market convergence; investor caution over growth, optimism over policy easing, and deepening geopolitical risk.

While traders cited short-term catalysts such as Federal Reserve rate-cut bets and renewed US-China trade friction, the reality is that the rally’s foundations lie in longer-term macro and structural forces.

From central bank diversification to investor momentum and declining real yields, gold’s current strength reflects both a cyclical and secular shift in how capital seeks safety.

Key Points

- Gold’s record-breaking rally in 2025 reflects a mix of policy easing expectations, persistent inflation, and rising geopolitical uncertainty.

- Structural demand from central banks and sustained ETF inflows have reinforced gold’s long-term strength and limited downside volatility.

- For traders, gold serves as both a market sentiment gauge and a practical hedge amid shifting monetary policies and global risks.

Rate-Cut Expectations and Inflation Pressures

The Fed’s policy pivot remains at the core of gold’s momentum. Markets are now pricing in two 25-basis-point (25bp) cuts before the year is out, beginning at the 28-29 October meeting, with futures implying 75 bps of easing through mid-2026 [2].

Meanwhile, the CME FedWatch Tool shows a near-97% probability of an October move, marking the fastest dovish repricing since the pandemic era.

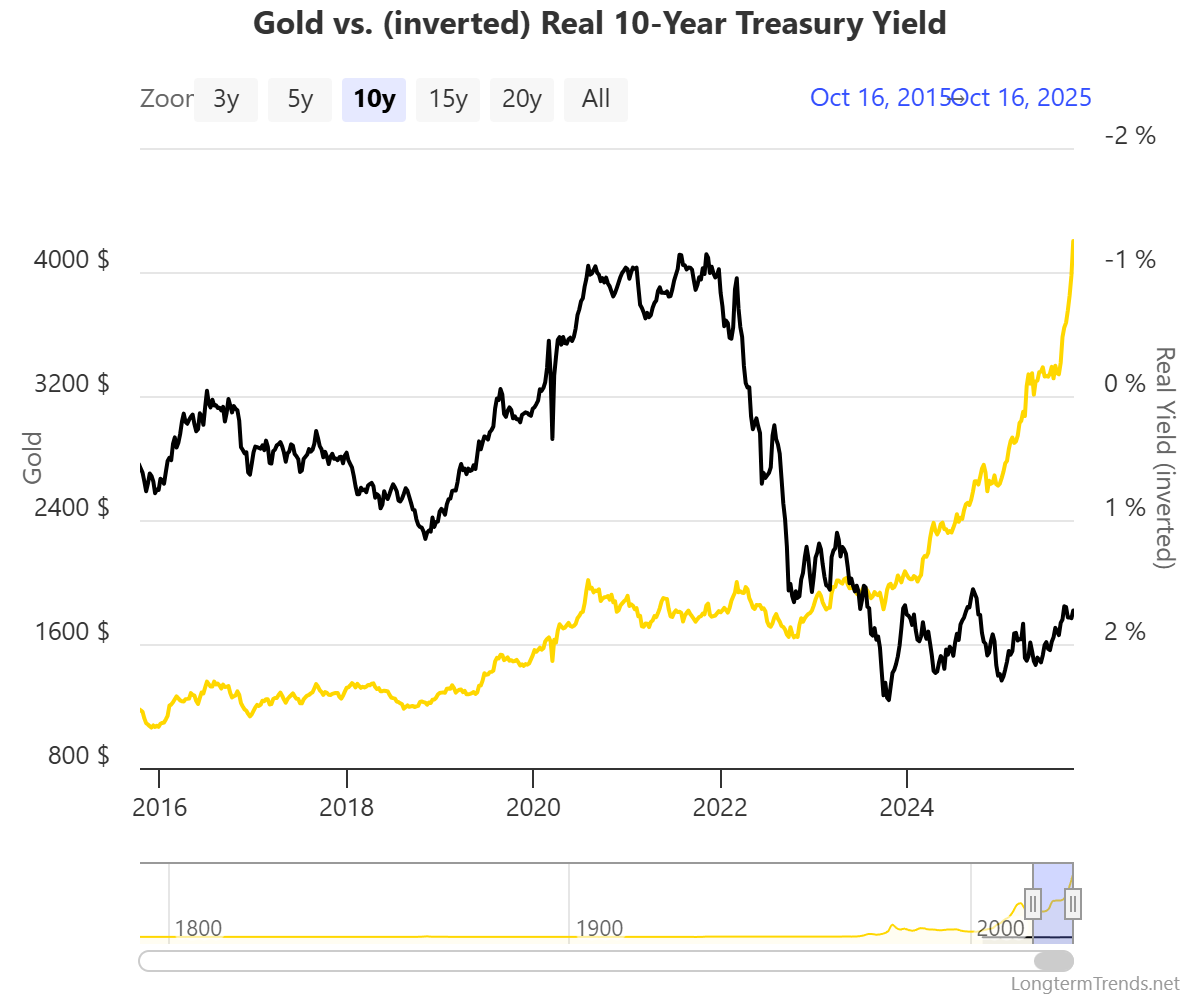

Lower nominal yields, combined with inflation that continues to hover just a hair below 3%, have compressed real interest rates. The upshot? That’s reduced the opportunity cost of holding non-yielding assets such as gold.

Federal Reserve Chair Jerome Powell’s recent remarks in Philadelphia that “the labour market is cooling faster than expected” further reinforced expectations for earlier accommodation in the form of lower rates.

The yield curve has steepened as 2-year Treasuries slide toward 3.35%, while 10-year yields hold near 4.10%, signalling easing liquidity [3].

As in previous cycles, easier US monetary conditions ripple outward, impacting all sorts of assets. The Fed remains the global benchmark for funding costs, and shifts in its stance alter cross-border liquidity, dollar direction, and risk sentiment. All of which shape gold’s trajectory.

Safe-Haven Demand Amid Political and Economic Uncertainty

Beyond yield dynamics, gold’s “insurance” role has reasserted itself in many investors’ portfolios. The US government shutdown earlier this quarter reignited fiscal anxiety, while escalating tariff threats and rare-earth export curbs between Washington and Beijing reminded investors that geopolitical volatility remains a permanent feature of the landscape.

During such episodes, correlations between gold and equities typically turn negative, underscoring its diversification power. Investors turn to bullion to buffer drawdowns, not necessarily to outperform risk assets, but to preserve real purchasing power.

Episodes of safe-haven rotation tend to follow a three-phase pattern:

- Shock recognition: Macro headlines trigger initial inflows into Treasuries and gold.

- Liquidity squeeze: When funding conditions tighten, gold benefits as a non-sovereign, decentralised store of value.

- Sentiment reinforcement: Price gains validate positioning, attracting trend-followers and ETF flows. Momentum wins out.

This reflex loop has been visible throughout 2025. Each geopolitical flare-up, whether that’s tariff rhetoric from President Trump or renewed Middle-East tensions, has produced higher intraday volatility in equities but smoother climbs upwards in gold.

The metal’s low correlation with major asset classes (over the long term) strengthens its appeal as a portfolio hedge during late-cycle uncertainty in global equities.

Central Bank Buying and the De-Dollarisation Trend

Perhaps one of the most overlooked factors behind gold’s resilience lies with central banks. Official sector demand has remained steady throughout 2025.

This sustained buying reflects a broader shift in how reserve managers approach their responsibilities. The motivations appear increasingly strategic rather than cyclical, suggesting a structural change in the way central banks view gold’s role in their portfolios.

- Diversification: Many emerging-market central banks view gold as an alternative to US Treasuries amid mounting fiscal and geopolitical risks.

- Currency hedging: Persistent dollar volatility so far this year has increased the appeal of assets outside the hegemonic dollar system.

- Trust and autonomy: Gold carries no counterparty risk, making it uniquely suited for sovereign balance sheets during sanctions-driven fragmentation, with economic coercion increasingly being used as a deterrent.

The WGC’s 2025 Central Bank Gold Reserves survey, carried out between February and May 2025, showed that over 95% of central banks plan to maintain or increase gold holdings over the next 12 months [4].

This trend has created a structural floor for the market. Even if investor flows ease, consistent central bank demand continues to provide support and sustain gold’s long-term upward trajectory.

ETF Inflows and Investor Momentum

Once a rally begins, ETFs transform sentiment into scale. They bridge the gap between narrative and execution, allowing investors to express macro views instantly.

Global inflows into gold-backed ETFs have exceeded $64 billion year-to-date, with $17.3 billion entering gold ETFs in September alone [5]. This phase of the cycle is marked by reflexivity, where price action fuels positioning:

- Momentum trading: Quant and systematic funds respond to breakouts above key resistance levels (e.g. $3,950 and $4,100).

- Retail participation: Rising media coverage and increased accessibility via online brokers accelerate secondary demand.

- Portfolio rebalancing: Multi-asset funds raise gold allocations to maintain volatility targets as equities appreciate alongside the yellow metal.

The result is a feedback loop. As inflows grow, ETF sponsors buy physical bullion, shrinking available supply and amplifying spot prices.

Historical Context: Gold’s Cycles of Record Highs

Gold’s journey rarely occurs in isolation. In fact, it mirrors global policy and liquidity cycles. Here are some past periods where price action in gold picked up steam.

- 2008–2011: Financial crisis and quantitative easing (QE) pushed gold from $700 to $1,900.

- 2016–2018: Brexit, dollar softness, and nascent trade frictions sustained prices above $1,300.

- 2020–2021: Pandemic stimulus saw a spike above $2,050 before consolidation.

In each period, the common denominator was monetary accommodation combined with uncertainty. The 2025 rally fits this template, only this time there’s significantly larger structural reinforcement from central-bank and ETF demand.

Year-to-date, spot gold has gained roughly 60%, outpacing all major equity indices. That pace rivals the post-2008 recovery but without the crisis-level volatility, indicating a policy-driven melt-up rather than a panic-driven surge.

Technical analysts highlight the next resistance cluster around $4,350 to $4,400, followed by an extension target near $4,600, should easing materialise from the Fed in 2026.

What Traders Can Learn from Gold’s Resilience

Gold’s current melt-up offers lessons that extend beyond the metal itself. For traders and portfolio managers, its behaviour provides a real-time gauge of macro risk sentiment and liquidity dynamics.

1. Watch Real-Rate Momentum, Not Just the Fed

Short-term nominal cuts matter less than inflation-adjusted yields. Sustained rallies occur when real yields trend downward for multiple quarters. Monitoring breakeven inflation and Treasury TIPS spreads provides an early signal.

2. Respect the Role of Structural Demand

Central-bank buying and de-dollarisation ensure that dips may attract official support. Unlike speculative flows, these are price-insensitive and persistent.

3. Manage Positioning Through Cycles

While gold’s volatility has dropped relative to equities, leverage in futures and options markets remains high. Use trailing stops or scale exposure via ETFs rather than futures during parabolic phases in price action.

4. Use Gold as a Cross-Asset Signal

Rising gold alongside rising equities often signals liquidity-driven inflation expectations, whereas gold diverging from equities tends to flag risk-off sentiment. Both can inform hedging or sector-rotation strategies.

5. Recognise Reflexivity

Gold’s rallies frequently extend longer than models imply because flows themselves alter fundamentals (ETF buying tightens supply; higher prices validate diversification decisions). Staying flexible, rather than fighting momentum for the sake of it, is key.

In practice, professional/institutional investors often use gold as a liquidity compass. When gold rises amid benign credit spreads, it implies hedging demand, not systemic stress.

When gold and volatility indices surge together, risk aversion has likely crossed into panic territory.

Bottom Line: Gold Shines But Remain Practical

Gold’s climb above $4,200 is more than a headline. It encapsulates a confluence of easing policy expectations, persistent inflation risk, geopolitical fragmentation, and structural diversification away from the dollar.

With real yields falling, central banks accumulating gold, and ETFs amplifying momentum, the metal’s multi-year resilience reflects deep currents in global macroeconomics. In some ways, it’s not the speculative froth it’s being made out to be.

However, traders should treat gold as both a barometer and ballast: it holds a mirror up to market psychology and acts as a practical hedge when conventional correlations break down.

Whether the next leg higher unfolds smoothly or through consolidation, gold’s message remains clear; in an era of monetary recalibration and geopolitical transitions, confidence has a price, and right now it’s measured in ounces of a certain yellow metal.

Reference

- “Gold extends record run past $4,200 on rate-cut hopes, safe-haven fervor – CNBC”. https://www.cnbc.com/2025/10/15/gold-crosses-4200-for-first-time-on-fed-rate-cut-bets-us-china-trade-woes.html . Accessed 17 Oct 2025.

- “Federal Reserve to cut rates by 25 basis points at next two meetings: Reuters poll – Reuters”. https://www.reuters.com/markets/rates-bonds/federal-reserve-cut-rates-by-25-basis-points-next-two-meetings-2024-10-29/ . Accessed 17 Oct 2025.

- “POLL Long Treasury yields to stay elevated as inflation, debt pressures blunt Fed easing – Reuters”. https://www.reuters.com/business/long-treasury-yields-stay-elevated-inflation-debt-pressures-blunt-fed-easing-2025-10-14/ . Accessed 17 Oct 2025.

- “Central Bank Gold Reserves Survey 2025 – World Gold Council”. https://www.gold.org/goldhub/research/central-bank-gold-reserves-survey-2025 . Accessed 17 Oct 2025

- “Investors flock to gold ETFs as metal’s price shatters records – Reuters” https://www.reuters.com/world/india/investors-flock-gold-etfs-metals-price-shatters-records-2025-10-07/ . Accessed 17 Oct 2025.