Dovish dots and hawkish Powell see choppy markets

* Fed delivers expected 25bps move, but only Miran dissenting

* Chair Powell cautions against over-dovishness, with ‘risk management’ cut

* Whippy dollar posts fresh multi-year low before bouncing

* Stocks mixed as Dow outperforms Nasdaq and benchmark S&P 500

* Bank of Canada cuts rates and is ready to cut again if risks rise

FX: USD whipsawed after a volatile day which saw fresh multi-year lows after the FOMC statement release to 96.21. This was on the back of the median dot plot for this year adding in another 25bps of cuts, so two more moves, an additional one for 2025 since the June meeting, and more in line with the 70bps of cuts markets priced in before today’s decision. The language was also tweaked highlighting increased risks towards the job market. But it was a confusing picture with the dovish dot plot conflicting with higher inflation and some labour dynamics. The more hawkish Powell press conference saw bargain hunters step in as the Fed Chair said policymakers don’t need to move quickly on rates and the cut was actually a ‘risk management’ one. The Dollar Index closed above the long-term upward trendline from 2011.

EUR was a big underperformer, after prices made a fresh high at 1.1918 before finishing lower on the day and below the prior top at 1.1830. The final euro area CPI figures were generally in line with expectations, printing 2.0% y/y on headline and 2.3% y/y on core. ECB communication remains broadly neutral as policymakers signal their preference for stability. The late July high may offer initial support around 1.1788.

GBP outperformed its peers after an inline CPI report though services dropped more sharply than expected. The next rate cut is not fully priced until Spring 2026. See below for more on today’s BoE meeting and cable.

JPY dipped to a low of 145.48 before settling back in the range from the start of August. The 100-day SMA resides at 146.17 and capped the downside. Trade data sprang an upside surprise while the yen is supported by narrowing yield differentials.

AUD traded defensively and was the weakest major on the day. That is not surprising after its stellar break to the upside. Prices didn’t get as far as the next Fib level at 0.6721, with eyes on today’s jobs data. CAD was the second best performing major after the BoC cuts rates as expected. There was no forward guidance, but rate setters kept their options open with the assessment on inflation, growth and the labour market pointing to another cut towards the end of 2025. The head and shoulders reversal pattern we highlighted yesterday has not played out yet, as prices trade around the 50-day SMA at 1.3772.

US stocks: The S&P 500 lost 0.1% to close at 6,600. The Nasdaq slid by 0.21% to settle at 24,224. The Dow Jones finished at 46,108, up 0.57%. It made a fresh intraday record peak at 46,261 before paring gains. Sectors were mixed with Tech, Industrials and Consumer Discretionary among the five sectors in the red. Financials and Consumer Staples were the clear outperformers. Nvidia (-2.62%) led the megacaps lower as China shunned their chips from Chinese tech companies. Apple finished up 0.35% even after iPhone sales in China were down -6% y/y in the July-August period; that compares with Chinese smartphone sales -2% y/y.

Asian stocks: Futures are mixed. Stocks traded mixed too with caution elevated ahead of the FOMC meeting. The ASX 200 eased back to its 50-day SMA as Tech and Utilities resilience was overcome by softness in Consumer Discretionary and Real Estate. The Nikkei 225 paused for breath after recent record highs as it closed below 45,000. Yen strength and mixed domestic data hampered the bulls. The Hang Seng and Shanghai Comp jumped with Hong Kong boosted by Baidu after an analyst upgrade due to optimism regarding its in-house chip venture. China also recently issued measures on increasing consumption.

Gold traded lower for most of the day but pared losses into the Fed announcement. A new record high was made immediately after the release of the Fed statement but selling ensued into and during the more hawkish press conference. Bouncing Treasury yields and the dollar eventually caused the sell-off.

Day Ahead – Australia Jobs, Bank of England meeting

Consensus expects 22k jobs in Australia added in August, roughly similar to the prior 24.5k. That was broadly in line with expectations, for what is typically a volatile release. The unemployment rate is likely to remain steady at 4.2%, after ticking one-tenth higher in July, resuming a very gradual upward trend in 2025. The labour market is seeing continued gradual softening, but this hasn’t hindered AUD in recent weeks with it outperforming all other majors. A benign Fed cutting cycle is a good environment for the major, and the relative quietness on US-China trade disputes has also helped. But markets price in a high chance of a November RBA rate cut.

The BoE will stand pat and keep rates unchanged at 4% after a 25bps ‘hawkish cut’ at its last meeting in August. The vote is likely to be a 7-2 split after the historic 5-4 and second vote at the prior rate decision. Growth and job concerns are increasing but inflation remains relatively sticky and the central issue for more policy easing. The headline is likely to stay above 3.5% for the remainder of the year though key services prices should ease. A ‘gradual and careful’ approach by the MPC should continue, with new economic projections not published until November.

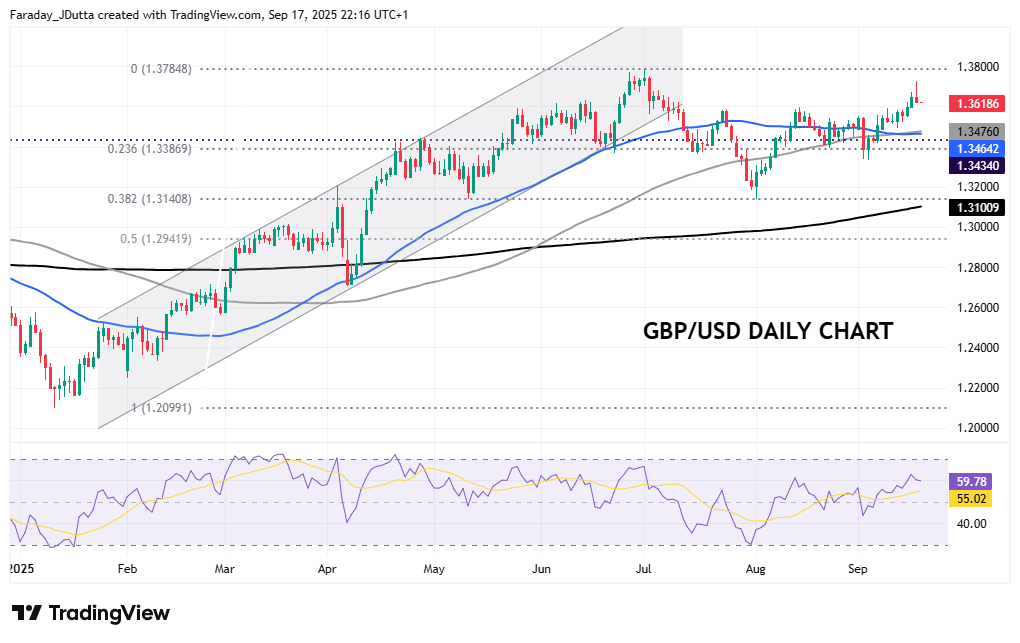

Chart of the Day – GBP/USD uptrend pauses

Sterling has been midpack versus the dollar for some months. A weak growth outlook and potentially depressing November Budget is battling with a moderately hawkish BoE who is fighting sticky inflation. But the pound has found fundamental support from US-UK yield spreads with rate cuts priced out in the UK, but priced in Stateside. Cable has picked up in recent sessions after breaking highs and resistance seen in late July and mid-August. The multi-year high sits at 1.3748 while the 50-day and 100-day SMAs are at 1.3464/76. Yesterday’s inverted hammer candlestick pattern is typically bearish.