Geopolitical worries ease, helping stocks and dulling the dollar

* Iran sees progress in nuclear talks with US; ‘tense’ talks on Ukraine

* US stocks little changed, AI “disruption trade” steadies

* Dollar gives up gains after initially strengthening

* Precious metals turn down as demand weakens during Lunar New Year

FX: USD ticked higher though demand stalled during the US session and the Index closed virtually unchanged. There wasn’t much new news with last week’s strong headline payrolls and benign inflation still being mulled over. Treasury yields stabilised after two strong down moves saw the 10-year get near to 4%. More than two 25bps Fed rate cuts (59bps) are still priced in for this year, with around a 25% chance of the first in April. US-Iran talks yielded a ‘general agreement’ on a potential nuclear deal.

EUR slid but closed off its lows and settled unchanged. German business ZEW survey data was weaker than expected. But interest rate differentials remain supportive, with yield spreads pulling back up toward their recent multi-year highs. Resistance sits at 1.1918 with the 50-day SMA at 1.1762.

GBP was the major underperformer on softer than expected jobs data. There was further cooling in wage growth (4.2%), softer than expected employment growth and January payrolls, all pointing to a weakening labour market. The unemployment rate rose to 5.2% at the end of last year, only just below the post-pandemic peak of 5.3%. March rate cut bets increased with focus now on today’s CPI figures.

JPY outperformed most of its peers. Long end yields fell quite sharply which could signal worries about government pressure on the BoJ. But it could also mean increased confidence in the bank’s ability to provide price stability. Initial support in the major is at 152.14/26.

US stocks: The S&P 500 added 0.1% at 6,843, the Nasdaq lost 0.13% at 24,702 and the Dow Jones gained 0.07% at 49,533. Only four sectors were in the green, with Real Estate, Financials, Tech and Industrials the gainers. Consumer Staples, Energy and Materials were the main underperformers as investors dipped into more cyclical sectors again, though software got hit again. A notable initial sell-off after the open saw the Mag-7 leading the decline, ex-Apple, although this was then swiftly pared through the afternoon. Apple stayed in the green with a key analyst saying 2026 would be the year it gets into the AI game. The company said it will hold a product launch in early March and announce several new devices in the coming weeks. Financials like JP Morgan and Citigroup outperformed as Fed officials said rates may stay restrictive for some time.

Asian stocks: Futures are mixed. APAC stocks were mixed with Lunar New Year sparking thin volumes on top of the US holiday. The ASX 200 moved higher helped by mining and BHP’s jump after a 28% jump in first half net revenues, though upside was capped by tech underperformance. The Nikkei 225 dipped as post-election euphoria eased.

Gold dipped as haven demand slowed on the prospects of a potential nuclear deal between the US and Iran. There may have been thinner liquidity during the Asian session due to the Chinese holiday. Near-term support was $4,878 but its this gets decisively breached, the 50-day SMA sits below at $4,632.

Day Ahead – RBNZ, UK CPI, FOMC Minutes

The RBNZ’s first meeting chaired by new Governor Breman is expected to keep the OCR steady at 2.25%. She tended to sit on the dovish side at the Riksbank but has kept all options open in her new role. The stronger economy and elevated inflation are likely to be acknowledged, but ongoing excess capacity and tighter financial conditions should offset this and mean steady rates for some time. Fresh inflation and policy rate projections may be revised higher, which would partly validate rate tightening market expectations for this year. Market pricing currently implies around 40bps of tightening by the end of the year, with 18bps priced for September. Any rate hike speculation will boost NZD while a more cautious meeting would hurt the kiwi.

Consensus predicts UK headline CPI at 3% from 3.4%, core at 3% from 3.2% and all-important services at 4.3% from 4.5%. The BoE sees the inflation outlook lower in the next six months with a big drop in April, primarily due to softer energy prices. This should help drag inflation closer to the BoE’s 2% target if not below. Governor Bailey recently said he expects to see “quite a sharp drop in inflation over coming months”. A 25bps rate cut is fully priced for April, with another fully priced for November following the latest jobs data.

The Fed minutes will see attention on the statement tweaks, which were more positive around the economy and labour market. Any hints on the neutral rate for policy should also be in focus. This meeting came before the recent stronger on the surface NFP and more benign CPI data releases.

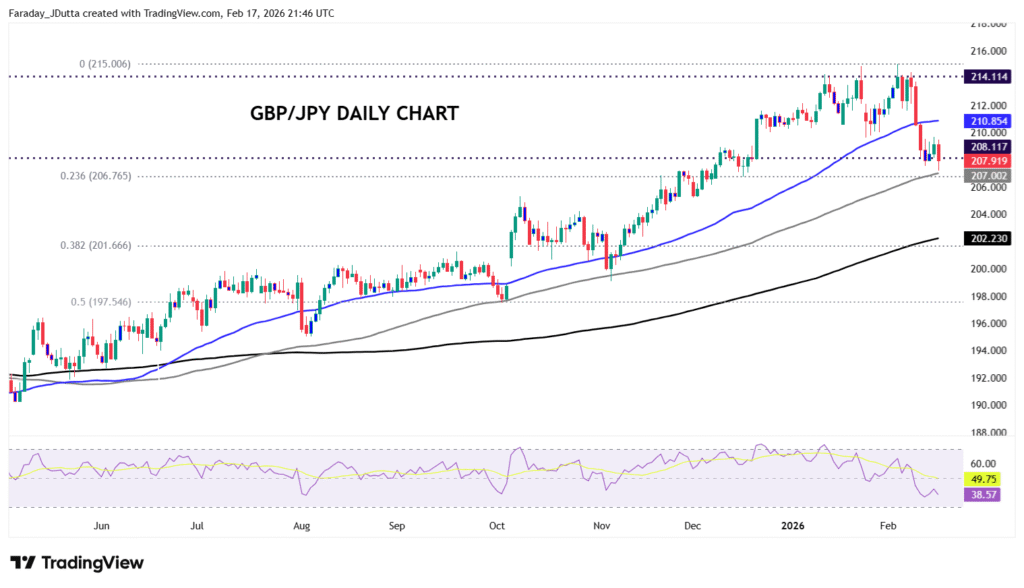

Chart of the Day – GBP/JPY back to long-term top

Has the bull channel from the April 2025 low been broken? Prices have been rising in this popular cross since the Liberation Day bottom at 184.36. The uptrend broke through a few long-term levels but hit major resistance several times in recent weeks around the August 2008 top at 214.14. Since the spike top at 215, the pair has turned sharply lower through the 50-day SMA at 210.85, which has been support all the way up. Prices recently found other support at another long-term level at the July 2024 peak at 208.11. The first fib level (23.6%) sits just below here at 206.76, with the 100-day SMA at 207.