Mixed US data sees two-way price action

* Dollar relatively unchanged after ‘distorted’ NFP report and retail sales

* Wall Street ends mixed as energy sinks, while tech steadies

* Tesla shareholders approve $1trn Musk pay package, stock hits highs

* Crude slumps to near 5-year lows on Russia-Ukraine peace efforts

FX: USD fell again, printed its low for the day after NFP but then found some buyers. The headline number came in at 64k vs 50k expected, the jobless rate was 4.6%, one-tenth higher than estimates and annual wage growth was 3.5%, the lowest in over four years. Economists note that over the past three years, more than 90% of all the jobs the US have created have come in just three sectors which are non-cyclical like healthcare. Odds of Fed rate cut bets barely moved for the January meeting, with a marginal firmer bet on a March move. The headline retail sales number was soft but the control group, which has a better record of tracking broader consumer trends was much firmer than predicted.

EUR pushed higher for a fifth straight day, though gains were pared through the day. The intraday high was just above 1.18. EUR initially saw marginal strength after French manufacturing PMI surprisingly rose into expansionary territory. But that earlier strength was then reversed on the weak German report which showed manufacturing slipped further into contraction. The outlook for relative central bank policy is still supportive for the euro, especially with this week’s well-telegraphed ECB hold.

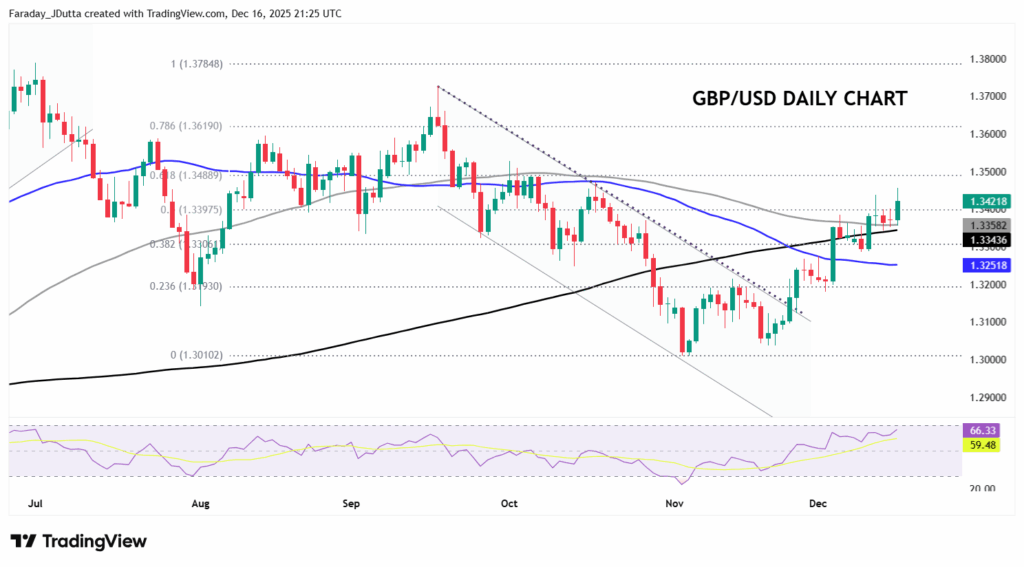

GBP was the top performing major as it printed a top at 1.3455, a level last seen in mid-October. Sterling was helped by stronger than expected domestic data releases. The October employment figures delivered firmer wage growth along with a better than feared employment decline. The PMI’s surprised modestly at levels implying modest growth (just above the 50 threshold).

JPY strengthened for a second day close to one-month highs, as the major dipped close to the 50-day SMA at 154.19. Fundamentals remain supportive as markets eye Friday’s BoJ meeting and consider the prospect of a more robustly hawkish tone with guidance for both higher policy rates

US stocks: The S&P 500 lost 0.24%, closing at 6,800. The Nasdaq moved higher by 0.41% to finish at 25,170. The Dow settled down by 0.62% at 48,114. Energy was the big losing sector as oil prices sank below $55, to their lowest levels since early 2021. Healthcare also struggled as the rotation trade paused. Pfizer sunk over 5% after the drugmaker forecast a challenging 2026 due to weaker sales of Covid-19 products and squeezed margins. Tech megacaps were mixed with Tesla making a fresh record high after gaining just over 3%. While Oracle and Meta added between 1.5 – 2%. Only Tech, Consumer Discretionary and Communication Services were in the green.

Asian stocks: Futures are mixed. APAC stocks were mostly lower after the weak lead from Wall Street, as the tech-related pressure rolled over into the region. The ASX 200 slipped amid underperformance in the tech, energy and resources sectors, while data showed consumer sentiment deteriorated. The Nikkei 225 fell beneath the 50,000 level amid a firmer currency, BoJ rate hike expectations and underperformance in tech and electronics stocks. The Hang Seng and Shanghai Comp were hit amid the tech woes, especially on the Hong Kong benchmark.

Gold just about printed a sixth straight day of gains, but it was a doji candle more or less denoting a pause for breath just below the all-time top from October. Fed rate cuts underpin support but peace talks about Ukraine may be seeing some haven bids fade.

Day Ahead – UK CPI

Analysts estimate UK inflation figures in line with the BoE’s latest forecasts. The headline rate is seen at 3.5% from 3.6% and core steady at 3.4% after falling for three straight months. Black Friday discounting should help. This report comes after yesterday’s UK private sector wage data which should allow the BoE to cut rates on Thursday.

Chart of the Day – GBP bull momentum continues

Since bottoming out at 1.3010 in early November, cable has been one of the top performing majors, and the best over the last one-month. A double bottom reversal pattern formed which we highlighted. Prices have broken higher in textbook fashion with strong moves to the upside after bullish consolidation flag patterns. Support sits around the 100-day and 200-day SMAs at 1.3358 and 1.3343. The major is now just above the midpoint of the July to November move around 1.34. The major Fib level above (61.8%) sits at 1.348.