Nivida beats on top and bottom lines…and sells off

* Nvidia stock slips despite earnings beat as China sales remain uncertain

* S&P 500 posts record close ahead of Nvidia quarterly results

* Fed’s Williams say every policy meeting is ‘live’ for rates

* EU to propose removing US tariff this week to appease Trump

FX: USD was choppy as initial gains, which took the index back to levels seen before the Powell pivot at Jackson Hole, were given back and the buck finished more or less flat on the day. The Trump attempt to fire the Fed’s Cook could run into legal wrangling and last a few months. The most visible market impact so far has been the underperformance of 30-year Treasuries and yields move lower through the day. The Trump administration is reviewing options to exert more influence over the Fed’s 12 regional banks, something we mentioned recently, and that is a move that would only accelerate concerns over Fed independence and its ability to keep inflation expectations anchored.

EUR underperformed with political uncertainty still in investors minds. News of a no confidence vote in the Netherlands compounded existing worries around France. The initial shock from Paris and alternatives like new governments has been absorbed but may rear its head in the build up to the confidence vote in early September.

GBP touched the 100-day SMA at 1.3433 and rebounded to finish just above the 50-day SMA at 1.3491. Hawkish repricing of BoE rate cut expectations is underpinning support for the pound. The UK regulator Ofgem raised the energy price cap by 2% for October to December, a touch higher than the expected 1%.

JPY weakened despite Japanese government bond yields climbing higher and so narrowing the spread with US Treasuries. The 50-day SMA is acting as support at 146.94.

AUD outperformed most of its peers as inflation data came in hotter than expected, with the main driver being volatile electricity prices which might be reversed in the coming months. The RBA is only predicted to make a next rate cut step in November. CAD strengthened again and broke down. The outlook for relative central bank policy remains supportive of the loonie versus the dollar, with two-year US-Canada spreads hitting fresh 10-month lows.

US stocks: The S&P 500 printed up 0.24% at 6,481. It was a record close, and the index is up 10.2% y-t-d. The Nasdaq settled up by 0.17% at 23,566. The Dow Jones finished higher at 45,565 adding 0.32%. All sectors were in the green apart from three which were very modestly lower – Communication Services, Health and Industrials. Energy, Tech and Real Estate led the gainers. All eyes were on Nvidia results which were released after the US closing bell. Key data centre revenue missed while guidance failed to wow the bulls. Similar to what happened in the prior two quarters, markets may now assume margins have peaked and the story is now less about hypergrowth and triple-digit gains. The tepid outlook adds to concern that the pace of investment in AI systems is unsustainable. Difficulties in China have also clouded Nvidia’s business. The stock was down just under 3% after hours. Shares of other AI-related hardware stocks also fell in after-hours trading following Nvidia’s results.

Asian stocks: Futures are mixed. Regional markets were generally green but rangebound. The ASX 200 was supported by mining and materials after Woolworths plunged by double digits after a 19% drop in profits. The Nikkei 225 closed marginally higher with yen weakness helping. The Hang Seng and Shanghai Composite was muted ahead of big bank earnings releases and US-China talks resuming later this week.

Gold rebounded from intraday losses and closed marginally lower just off its highs for the session. That matched a move lower in Treasury yields.

Day Ahead

Market have shrugged off some news and held on to other headlines as price action has been relatively choppy this week. The big sell-off in the dollar after Friday’s Powell pivot was followed by the Trump / Fed / Cook event which traders seem to have already moved on from. Decision making won’t change at the Fed in the near term, with Cook legal challenges potentially ahead and Powell still at the helm. Data is currently driving interest rates, and by May 2026 post-Powell, money markets predict 100bps of rate cuts by then, kicked off by a move next month. Anything further out is really too far for markets to price in.

The euro hasn’t been able to take advantage of any dollar softness though French bond markets have steadied. Markets are still making up their minds about the outcome of the upcoming France confidence vote and don’t seem in a rush to price snap elections as the baseline scenario. EUR/GBP has dipped below its 50-day SMA at 0.8634 but needs to break decisively lower through August lows and support just below 0.86.

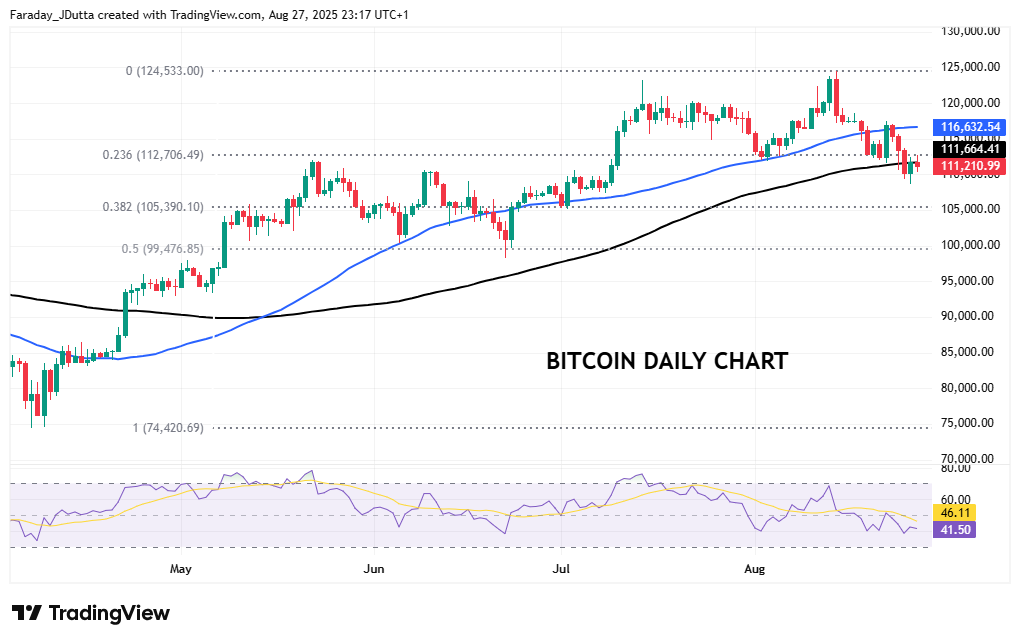

Chart of the Day – Bitcoin trying to find support

The world’s most popular cryptocurrency has disappointed since breaking higher to a record peak at $124,533 in the middle of the month. But that top saw the biggest one-day sell-off since early April, with the spike high on the weekly chart along with that in mid-July, looking bearish. Bitcoin traditionally sees its smallest gains in September, a month that the crypto has never finished more than 8% higher. There could be some front running ahead of this, while profit taking, large-scale whale selling and liquidations have caused the move to the downside. Prices currently trade around the 100-day SMA at $111,665. A major Fib level (38.2%) of the April to August move sits at $105,390. Upside levels include the 50-day SMA at $116,633 and the minor retracement level of that multi-month move at $112,706.