Quiet trading day with eyes on talks and UK data

* Shares edge up in thin-traded holiday markets, US and China on holiday

* Dollar rises while yen eases after weak growth figures

* Gold kicks off new week muted after upbeat inflation spurred rate cut bets

* Geopolitical concerns rise with key nuclear and peace talks today

FX: USD traded in a relatively narrow range again, trading around 97. Remember the Dollar Index is dominated by the euro, which holds a 56% weighting in the six country/currency gauge. Better US data hasn’t helped the greenback too much recently with the mid-January ‘Sell America’ phase very tough to shake off. The NFP report confirmed this with strong data and hawkish repricing only seeing a very modest dollar rally. But in the last two sessions, yields have sunk with over 60bps of Fed rate cuts now expected this year. Q4 GDP and Core PCE figures will be important, along with geopolitical tensions around this week’s US/Iran nuclear talks and Russia/Ukraine peace discussions.

EUR continued to consolidate in a narrow range around 1.1850. Surveys are the main data points his week with the German ZEW today and PMIs released on Friday. Resistance sits at 1.1918 with the 50-day SMA at 1.1759.

GBP was mid-pack and mildly lower on the day ahead of a busy data calendar this week. A March BoE rate cut is likely according to money markets, while political noise has abated for the time being. Betting markets see a near coin flip chance PM Starmer will step down by July.

JPY underperformed as the major found some support after the sharp sell-off last week. Q4 2025 GDP missed the expected 0.4% with a quarterly pace of 0.1% But details were less worrisome, with weak public investments and notoriously volatile private inventories being the main culprits. PM Takaichi’s strong mandate and election pledges suggest government spending is about to shift into a higher gear.

US stocks: Markets were closed for the President’s Day holiday.

Asian stocks: Futures are mixed. APAC stocks were positive though regional conditions were thinner due to several holidays. The ASX 200 edged higher helped by tech gains but utilities and mining underperformed. The Nikkei 225 was muted on disappointing Q4 GDP which missed estimates. The Hang Seng closed higher in a holiday shortened session on the Lunar New Year Eve. The mainland was closed.

Gold was relatively quiet but closed just below $5,000. Softer yields after the cooler CPI data on Friday helped bullion recover at the end of last week. Rate cut bets were also reinstalled after the inflation figures. Near-term support is $4,878 and resistance at $5,119.

Day Ahead – RBA Minutes, UK Jobs

The RBA minutes are from the January meeting in which the bank raised rates for the first time in over two years. Policymakers signalled inflation is still too strong and may take longer to control. The bank also noted a tight jobs market and resilient consumer demand, suggesting price pressures aren’t going to ease quickly. Markets price in a 70% chance of the next 25bps hike in May, and 30bps by August.

It’s mid-month so that means the usual UK data dump. First up is today’s labour market data, with inflation readings also providing fresh fodder for markets tomorrow, and retail sales numbers on Friday. This comes as investors are still digesting the fallout from the recent instability at the heart of PM Starmer’s government. Jobs data due will show if a gradual cooling of wage growth, closely watched by the Bank of England, has continued.

Expectations are for further signs of cooling in annual earnings and deterioration in the labour market with Governor Bailey recently stressing the importance of wage growth. Earnings ex-bonus are expected to rise 4.2% from the prior 5.1%, and unemployment is forecast at 5.1%, with the usual caveat around data reliability issues with the latter figure. Softer data could seal a rate cut which is already strongly favoured by money markets at next month’s BoE meeting.

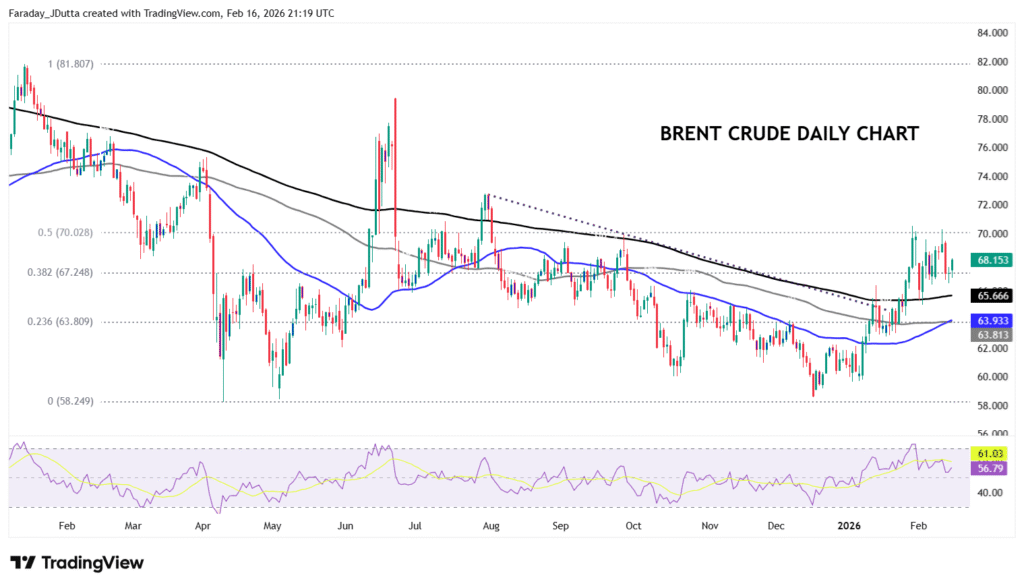

Chart of the Day – Brent crude choppy above support

Comments from President Trump at the end of last week, saying that regime change would be best for Iran, underpinned support for Brent. Prices also edged higher on Friday helped by a softer-than-expected US CPI print. There is still a large risk premium priced into the market given the uncertainty over how the situation between the US and Iran evolves. Betting markets put a 43% probability on a military strike by June. This all come ahead of further US/Iran talks scheduled in Geneva for today.

Meanwhile, the US will also be leading the Russia/Ukraine talks also starting the today. A tone which is more de-escalatory should see the market start pricing in a smaller risk premium, which would allow more bearish oil fundamentals to take centre stage, driving oil prices lower. Prices are currently just above a major Fib level (38.2%) of last year’s high and low at $67.24. Recent highs sit around $70 while the 200-day SMA is $65.66.