Risk-off as tech sell-off resumes, metals slide

* Stocks drop on further AI disruption fears, defensives outperform

* USD steady again as headline job gains stabilises bear trend

* Gold dives below $5,000, silver drops 11% amid broad commodity sell-off

* US CPI set to remain steady after upside surprise in payrolls

FX: USD traded in a very narrow range with attention on precious metals and stocks. Markets digested reports that President Trump is looking to exit the North American trade pact. There was still some debate around the NFP data. Payroll gains were strong in headline terms and the unemployment rate dropped. But job added were heavily concentrated in the health sector and there were significant downward revisions to the past year’s data. However, more than two rate cuts are still priced in.

EUR stayed below the September cycle high at 1.1918 as the major printed a tiny doji and inside day. Sentiment is the key driver currently though yield spreads are climbing back to multi-year highs.

GBP was mid-pack again with cable fairly flat on the day. GDP disappointed broadly with 0.1% growth in Q4 2025, due to unexpected contraction in business investment and a greater than expected drag from trade. This doesn’t bode well for 2026 with tighter government policy and weak business confidence potentially hurting growth. That said the data is backward looking and also prone to seasonal factors, and had little impact on BoE expectations, with markets still pricing about 45bps of easing for 2026.

JPY gained for a fourth straight day, outperforming its peers again. The major sold off close to the late January lows around 152.14/09, as the safe haven qualities of the yen came to the fore. Markets have been continuing to increase bets on faster BoJ normalisation. Improved growth prospects, clearer policy strategy and inflation continuing to remain above the bank’s target have seen money markets price in a 60% chance of a March rate hike.

US stocks: S&P 500 was down 1.55% at 6,834, the Nasdaq was lower by 2.04% at 24,688 and the Dow Jones lost 1.34% at 49,452. Only three sectors stayed positive with Utilities, Consumer Staples and Real Estate in the green. Tech, Energy and Financials were the biggest losing sectors. It was a case of dumping AI stocks again, in software, gaming and financials whose businesses are being seen as most exposed to AI disruption, with rotation into defensives continuing. Apple slid 5% in its worst session since April, while Palantir, Broadcom and Meta lost between 2.3% and 4.8%. Defensives outperformed with McDonald’s adding 2.7% on decent earnings and Walmart hitting fresh all-time highs, gaining 3.8% ahead of its earnings next week.

Asian stocks: Futures are mixed. APAC stocks were ultimately mixed on earnings releases and the better-than-expected US jobs data. The ASX 200 was led higher by utilities and financials post-earnings, but with upside capped by hawkish rhetoric from RBA Governor Bullock. The Nikkei 225 initially climbed above the 58,000 level for the first time, but then briefly wiped out all of its gains as yen strength persisted. The Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark dragged lower by disappointing earnings releases, with the latter also weighed by tech/AI-related headwinds.

Gold sold off in volatile trading as silver lost over 11% on the day. Liquidation took hold across asset classes with profitable metal positions forced into selling. Treasury yields dipped with the 10-year hitting year-to-date lows at 4.10%. Lower yields typically help non-yielding bullion, but not in the current environment.

Day Ahead – US CPI

The delayed US inflation data is forecast to show both the headline and core prints rising 0.3% m/m and 2.5% y/y. The core strips out volatile food and energy prices and is the focus for policymakers at the Fed. January is typically a solid seasonal up-month while shelter prices could be elevated along with core services. Evidence of tariffs remains limited so far.

A hotter report, in tandem with the strong NFP headline and lower jobless rate, should give the dollar some support and push back the next Fed rate cut. That was moved from June to July after Wednesday’s monthly jobs data. But concerns still linger about the slow growth phase of the labour market due to most of the strength being narrow in three main sectors. The data revisions also revealed that 2025 hiring was far softer than previously recorded. In fact, after those changes, there were only 15k jobs added every month, rather than the initial 49k per month.

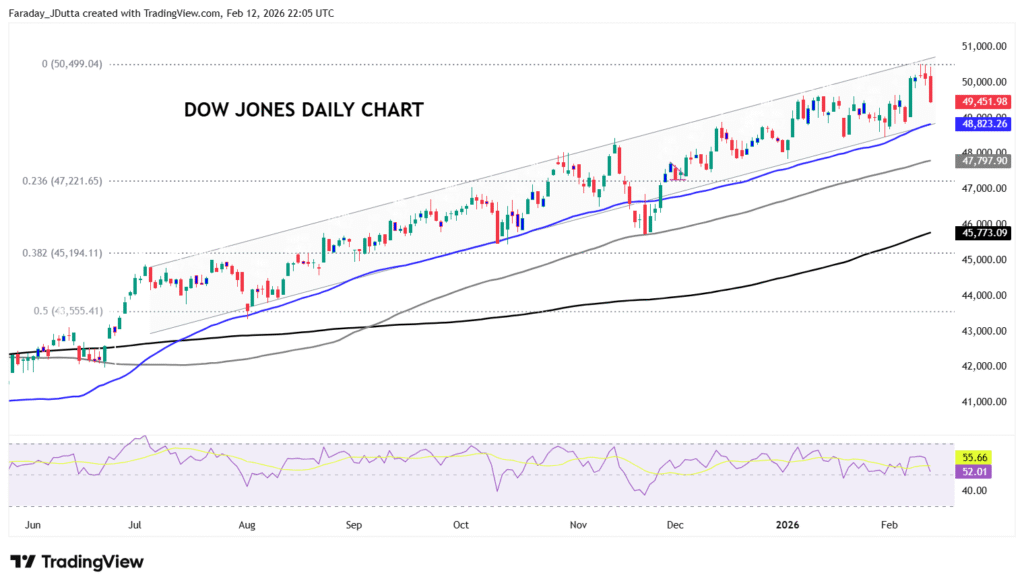

Chart of the Day – Dow dragged lower

Macro has recently not been the dominant stock market driver. The US and parts of Europe failed to meaningfully respond to the strong US labour data on Wednesday, which would normally be expected, particularly in cyclicals and financials. Instead, AI disruption fears continue to reshape risk appetite. Investors are reducing exposure to software and perceived “AI losers” while reallocating into old economy segments. That has seen the Dow outperform the tech-heavy Nasdaq. The current underperformance of cyclicals should continue in this environment with ongoing AI-disruption concerns the market’s big theme. CPI data needs to surprise big to upset this narrative. The 50-day SMA sits at 48,823 as initial support.