Risk-off trade as AI worries increase, BoE holds rates

* Dollar falls as weak labour data weigh

* Big Tech drags down S&P 500 amid jitters over highly valued stocks

* Sterling firms after BoE holds rates steady though MPC is divided

FX: USD turned lower after five straight days of gains. Wednesday’s price action touched the 200-day SMA, which is now at 100.34. The US Supreme Court on Wednesday sharply questioned President Trump’s broad use of emergency powers to impose global tariffs, although this risk event is likely to be a slow burner, touted to end in the first half of 2026. Challenger job cuts surged by 175% by the most in 22 years boosting Fed rate cut bets. There’s now above a 70% chance of a 25bps move in December.

EUR was firmer after five days of selling and three month lows. Markets weigh diverging central bank outlooks while ECB officials took a cautious tone with doves and hawks giving mixed views.

GBP was bid into the BoE decision and after too, having touched a 7-month low earlier in the week. The MPC held steady with inflation nearly double the target of 2%. But inflation is seen peaking, and the December meeting will see officials armed with more inflation data and post-the Budget. Governor Bailey seemingly holds the key vote, and his comments appears clear that hie will side with the doves. The BoE cycle is now priced to see a terminal rate of 3.25% next summer. Will a credible budget be enough to take a little more risk premium out the pound with a rumour/fact type event at the end of the month?

JPY turned lower as the safe haven appeal of the yen stood strong. Japanese Top Currency Diplomat Mimura noted that recent JPY moves are deviating from fundamentals and that excessive FX volatility, not levels, is the main concern.

US stocks: The S&P 500 lost 1.12%, closing at 6,720. The Nasdaq moved lower by 1.91% to settle at 25,130. The Dow Jones finished at 46,914, down 0.84% on the day. Only two sectors were green – Energy and Healthcare with Tech and Consumer Discretionary the biggest losers. Lots of stories and narratives as Nvidia CEO Huang warned that China could win the AI race against the US, while the OpenAI CFO spoke on a government backstop for its USD 1tln expansion; however, this was later walked back. CEO Altman also later clarified that they do not have or want government guarantees for OpenAI data centres. Tesla shareholders overwhelmingly backed CEO Elon Musk’s $1tn pay package hoping that the chance of a huge payday, the biggest in history will push him into focusing on the EV maker.

Asian stocks: Futures are mixed. Stocks were higher after the bounce back on Wall Street amid hotter US data. The ASX 200 edged higher on mining strength, but financials lagged on disappointing NAB full-year profits. The Nikkei 225 rebounded and touched the 51,000 mark before giving up some gains. The Hang Seng and Shanghai Composite were in the green on positive US-China vibes after China’s Commerce Ministry suspended the unreliable entity list announced in April.

Gold steadied just below $4,000, though Treasury yields ticked lower he retracing the break above the 10-year yield breaking above its 50-day SMA around 4%.

Day Ahead – Canada Jobs

This data will be gauged to see how the Canadian jobs market is faring amid elevated trade tensions between the US and Canada. These have hit economic activity with the Bank of Canada recently noting that the labour market remains soft. September saw impressive headline job gains of 60,400 roles, but the number of hours worked actually fell in the month and they came after two sizable down months, in what is a volatile data release.

This time around, consensus expect a flat to very mild negative print and the unemployment rate to stay high at 7.1%. That jobless rate held there from August when it hit a nine-year high outside of the pandemic years. Canada’s job gains this year have averaged about 24,000 jobs per month, almost 10,000 less than seen in the previous two years, as tariffs have either forced job cuts or dissuaded employers from hiring more.

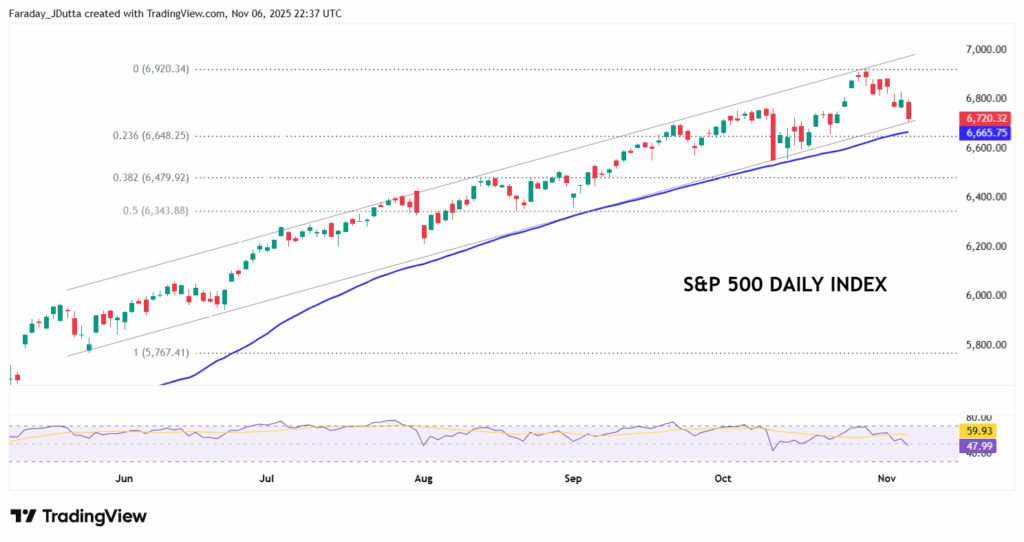

Chart of the Day – S&P 500 rolls over

The broad benchmark US stock index has stumbled as worries increase over valuations in techonology companies. The risk off move this week was kicked off by two CEOs, from Goldman Sachs and Morgan Stanley, who cautioned investors to brace for a drawdown over the next two years. But they did imply 10-15% moves lower happen often even through positive market cycles. They called periodic pullbacks healthy developments rather than signs of crisis. Prices have pulled back from the record highs from late October at 6,920. The 50-day SMA sits at 6,665 with a minor Fib retracement at 6,648. The index is now at the bottom band of the bull channel.