Tech again weak, USD lower ahead of today’s NFP

* Dollar edges lower, yen outperforms in data-heavy week

* Wall Street closes lower as investors continue to rotate

* Gold bolstered by Fed rate cut prospects and haven demand

* Oil falls further close to October low on oversupply concerns

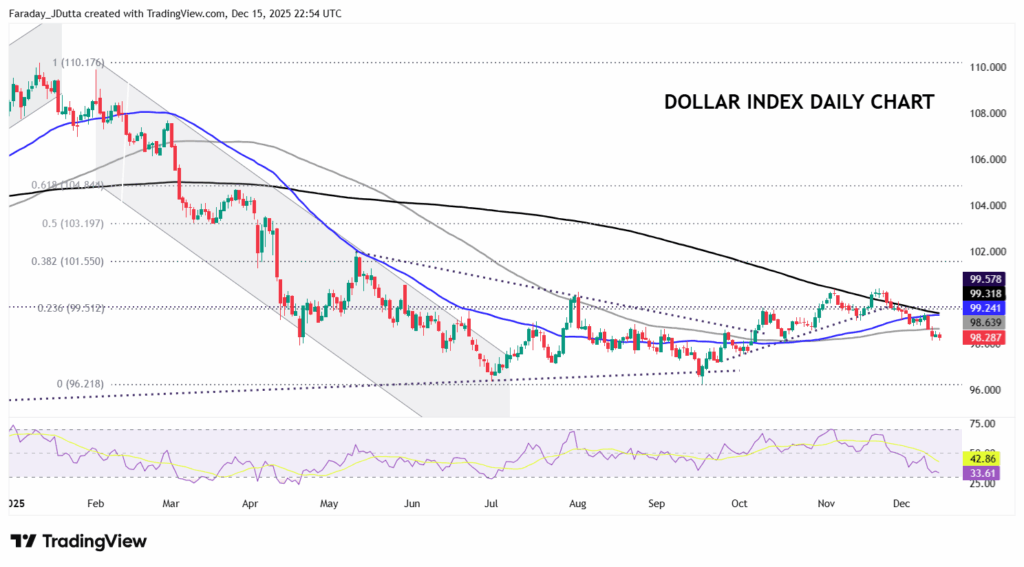

FX: USD dipped marginally just above recent lows. The 100-day SMA sits just above at 98.63. It’s one of the last big trading weeks of the year with NFP data today and a soft report possibly bringing forward the pricing of the next rate cut. See below for more details. CPI figures are released on Thursday where the annual rate is seen edging up to 3.1%, still well above the Fed’s 2% target.

EUR pushed higher for a fourth day, though the recent gains have been in small range trading sessions. The highlight of this week will be Thursday’s ECB policy decision which is expected to deliver a widely anticipated hold at 2%. A forecast upgrade has also been broadly communicated, lifting ECB rate expectations and delivering a fundamentally driven boost in the single currency to fresh two-month highs. Yield spreads are potentially breaking to wide levels not seen since mid-2023 which should further boost the major.

GBP printed a tiny doji candle ahead of a packed UK data dump this week. See below for a preview of today’s jobs figures. A rate cut by the BoE is fully priced in. Cable is trading just above the 100-day and 200-day SMAs at 1.3357 and 1.3343.

JPY led G10 gains, up around 0.5% against the dollar after the Tankan business survey met expectations, catching traders positioned for a weaker result. USD/JPY has slid toward the key 155 level, with downside focus on the 50-day SMA at 154.20 as momentum turned bearish near-term. Attention now shifts to US data for the major and also Friday’s BoJ, where a rate hike is widely expected.

US stocks: The S&P 500 lost 0.16%, closing at 6,816. The Nasdaq moved lower by 0.51% to finish at 25,067. The Dow settled down by 0.09% at 48,417. Health Care, Utilities and Consumer Discretionary outperformed, but Tech, Energy and Communication lagged as the only sectors in the red. Tech was the biggest underperformer, still pressured after the Oracle and Broadcom earnings releases last week. Lofty tech valuations weighed on risk sentiment with the session again showing a clear defensive tilt and cyclicals underperforming. The clear outperformer was Tesla, up 3.5% and hitting an all-time high amid driverless robotaxi tests. Energy stocks were hit as oil prices declined on Russia/Ukraine peace progress – with talks taking place today with Ukraine, EU and the US, and all sides seemingly optimistic with Trump suggesting they are closer than ever to peace. The market’s focus has shifted in recent weeks to the so-called “rotation trade” away from tech, offering insights into the US economy and its cross-border spillovers.

Asian stocks: Futures are mixed. APAC stocks were pressured at the start of a risk-packed week following tech-led declines on Wall Street amid a rotation out of AI. BoJ Tankan and Chinese activity data were monitored. The ASX 200 saw declines led by mining, materials, resources and tech sectors, with the mood in Australia also sombre following a terror attack on Bondi Beach. The Nikkei 225 underperformed ahead of a widely anticipated BoJ rate hike later this week, while the quarterly BoJ Tankan survey showed sentiment at the highest in four years, which supports the case for a rate hike. The Hang Seng and Shanghai Comp were muted after the Chinese activity data disappointed and house prices continued to contract, with tech and biotech leading the declines in Hong Kong.

Gold made fresh near 7-week highs again before paring gains through the day. The record high is at $4,380. All eyes are US data this week.

Day Ahead – US NFP, PMIs, UK Jobs

UK kicks off a big week for GBP with employment and inflation data ahead of a widely expected rate cut by the BoE on Thursday. The economic data would need to hugely miss to upset the 90%+ odds of the rate move by the MPC. Employment change is seen at -60k, unemployment up one-tenth to 5.1% and average earnings (ex-bonus) one-tenth lower at 4.5%. Easing labour market weakness is broadly predicted in the months ahead.

PMIs are seen as a leading indicator for economies and are expected to confirm a picture of decent activity. Services should boost the composite print in the eurozone, with reduced French political noise and progress on the German 2026 budget also helping. The November print marked a 30-month high in activity growth. The UK figures may see a partial unwind of the prior softness from pre-Budget nerves. But there could be lingering caution form firms holding back amid ongoing global uncertainty.

Consensus expects the headline NFP number to see 50k jobs added in November, below the prior 119k. October payrolls will be incorporated but October’s jobless rate will be absent after the shutdown halted the household survey collection. The unemployment rate is predicted to stick at 4.4%. Wage growth is seen at 0.3% m/m. The government shutdown more broadly may mean there is a lot of abnormal noise in the data. The recent Fed meeting cemented expectations of softer figures with Chair Powell’s dovish tone. He stressed labour market downside risks and warned of a persistent 60k monthly overcount in NFP.

Chart of the Day – Dollar lower into big week

Disappointing NFP data is likely to reinforce expectations that the Fed still needs to ease policy further, keeping the greenback on the defensive. There’s currently around a one in three chance of another rate cut in March. Seasonal patterns suggest the buck often softens toward the end of the year, while the broader trend continues to point to downside risks as the calendar turns. Adding to the focus on the dollar, President Trump said on Friday that he is considering Kevin Warsh and Kevin Hassett as potential replacements for Fed Chair Jerome Powell. He also argued that the next Fed chair should consult him on monetary policy and repeated his view that interest rates should be cut to 1% or lower. Near-term technical signals look negative, with prices below the 100-day SMA for the first time since early October – that is currently at 98.63. The 50-day (99.24) could be pushing above the 200-day SMA (99.31) which is a golden cross and bullish.