Tech bounces, dollar ditched to kick off busy week

* Dow Jones hits fresh record high, but Tech leads gains

* NEC’s Hassett expected slightly smaller job numbers on Wednesday

* Gold and silver push higher, bitcoin steadies around $70k

* Japan’s PM Takaichi pledges fiscal discipline, UK’s Starmer gets support

FX: USD fell sharply after stories early in the day that Chinese regulators had asked local banks to rein in exposure to US Treasuries due to market and concentration risk. Mainland China and Hong Kong together held roughly $938bn of US Treasuries, as of last November. Stories like these come at a vulnerable time for the dollar, when the ‘Sell America’, de-dollarisation and diversification themes are rife. Focus in on data this week with NFP on Wednesday, swiftly followed by Fridays’ inflation report – it’s a rare event to have the two biggest data points in such quick succession.

EUR jumped 0.85% as the world’s most trade currency pair got a boost from the Chinese US Treasury story. Despite being fragmented, Europe offers the best alternative in terms of depth and liquidity to the US Treasury market. Long positioning is stretched in the major, which may mean it struggles to advance a lot further. But NFP looms large with a weak report potentially boosting dollar bears. The September cycle high sits at 1.1918 with the late January top at 1.2082.

GBP was midpack versus the dollar but sold off versus other peers. Political uncertainty ramped up with PM Starmer’s leadership under threat and a potential more left-wing new leader. That could cloud the UK’s fiscal outlook and see much more downside in sterling if gilt yields surge. However, the immediate risk may have subsided after cabinet ministers backed him to stay. Eyes are on a by-election at the end of the month, ahead of local elections in May. Last week’s dovish BoE meeting is also dragging on the pound, with rate cut bets pulled forward and now pricing in a 25bps cut for April, which was previously predicted in June.

JPY gained as the major hit a high of 157.66 before falling through the day. PM Takaichi’s gamble of a snap election paid off with a landslide win for the LDP party and a two-thirds supermajority in the lower house that was the highest proportion in post-war Japan. Compromises don’t have to be made with coalition partners and the LDP is now immune to (spending) pressure from the opposition given its strong mandate. That said the PM endeavoured to stress her commitment to fiscal discipline. Consensus was for a weaker yen – see below for more. Jawboning by Finance Minister Katayama helped push the major further away from the 159 resistance zone.

US stocks: S&P 500 added 0.42% to close at 6,961, the Nasdaq was up 0.77% at 25,268 and the Dow Jones was higher by 0.04% at 50,136, a fresh record high. Tech, Materials and Energy led the gainers with four sectors in the red, while Health and Consumer Staples were the main laggards. Semis rallied, which continued their outperformance likely due to the increased capex plans announced last week in Big Tech’s earnings reports. Broadcom gained 3.3% and Nvidia added 2.5%. Oracle jumped 9.6% after a broker upgrade tied to AI demand. Battered software stocks were mixed with Synopsys and Salesforce in the green. Last week saw the latter trading at 14x earnings compared to tits 10-year average of 46x. Software, financial services and asset managers lost more than $600 billion from their market values.

Asian stocks: Futures are green. APAC stocks began the week positively after Friday’s rally Stateside, where the DJIA topped the 50k level for the first time. The ASX 200 rallied with all sectors in the green and advances led by broad strength in tech, real estate, miners, materials and resources. The Nikkei 225 rose to fresh record highs above 57,000, after the PM Takaichi’s LDP won a supermajority in the lower house election. That means it can override the upper house in legislation, while paving the way for the government to proceed with further stimulus and a sales tax cut. The Hang Seng and Shanghai Composite conformed to the widespread upbeat mood across the region.

Gold added nearly 2% as bugs looked to build a base around $4,800 and above $5,000. The weak dollar helped but precious metals are still in thrall to the recent shake out. Fundamentals still matter over the long-term, but the near-term shift points to positioning and momentum playing a bigger role, leading to more volatility.

Day Ahead – US Retail Sales

Consensus expects the headline to rise 0.4% versus the prior 0.6%. Sales should maintain a firm pace of growth with lower and higher income groups continuing to diverge. The latter are benefiting from wealth effects through investment and record high stock markets, but the former are being impacted by higher prices and tariffs. This is the ‘k-shaped’ economy with the top of the ‘k’ representing the top 40% by income, who account for more than 60% of all consumer spending. These households control nearly 85% of America’s wealth, so some economists believe forecasting the overall labour market may be less important than forecasting the direction of the market itself to anticipate consumption levels and ultimately, the path of the economy.

Focus is on the NFP and CPI reports later in the week though bond markets have reacted to the China stories. That has seen more rate cut bets in market pricing with around 55bps seen by end-2026, from below 50bps at the start of the day. There’s near enough a one in three chance of an April rate reduction.

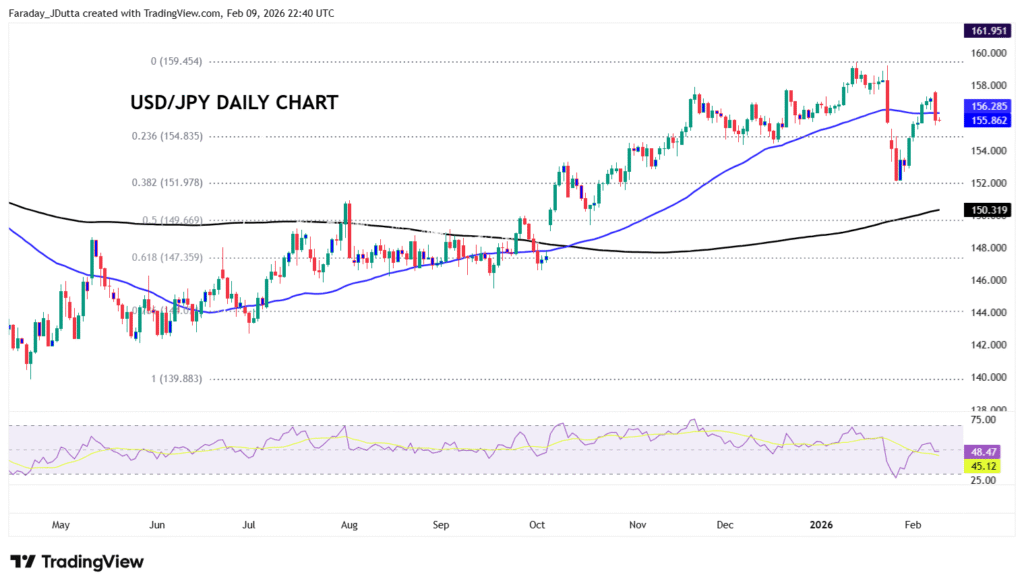

Chart of the Day – USD/JPY lower as yen strengthens

The yen has surprised many, including us, by gaining after the resound victory by PM Takaichi. Consensus had been that a big LDP win would trigger a large sell-off in both Japanese Government bonds and JPY, as an unchecked LDP would push ahead with unfunded fiscal giveaways and lean on the Bank of Japan not to tighten. But Takaichi has struck a remarkably measured tone, seeking to assure markets on her fiscal plans by arguing that the temporary tax cut on food would not require the issuance of fresh debt. Maintaining stability in the government bond market is key though many observers think Abenomics 2.0 means Japan is about to run the economy hot. Interestingly bets on an April BoJ rate hike now sit at 60%. For USD/JPY, today’s engulfing outside reversal is bearish and seen prices fall below the 50-day SMA at 156.29. The gap window that opened in the recent supposed intervention period in the mid-155s is important for more downside. The big resistance zone resides around 159.