Tech wreck, crypto crunch but bullion bid

* Wall Street closed sharply lower on concerns over AI disruption

* Gold notches biggest daily gain ever, silver jumps 7.7%, bitcoin sinks

* Palantir rallies after bumper quarter fuelled by US defence spending

* AMD forecasts sequential revenue decline, shares fall 5.8% after hours

FX: USD was relatively quiet amid stock volatility as the index printed a narrow inside candle – not surprising after a few strong up days for the greenback. Broad sentiment remains modestly fragile with precious metals rebounding and US-Iran tensions higher after the shooting down of an Iranian drone. NFP and Jolts job data has been pushed due to the partial government shutdown.

EUR steadied after two strong days of selling with the daily RSI back in neutral territory after the highs close to 1.21 took the major into heavily overbought conditions. Yield spreads rewidened in favour of the dollar as market focus on EZ inflation and then Thursday’s ECB meeting. That said, it will be a quiet affair with policy still in a ‘good place’.

GBP was midpack in the majors with cable holding the September highs and minor Fib level of the November low to January high at 1.3685. The BoE meeting looms though no rate changes are expected and the vote split may be of most interest. A 6-3 pattern would be a dovish surprise even as markets have pared back rate cut bets in recent weeks.

JPY underperformed again as the major moved higher for a third straight day. The snap election is imminent with a landslide Takaichi win focusing market’s minds. The 50-day SMA sits at 156.26.

US stocks: S&P 500 lost 0.84% to close at 6,918, the Nasdaq was down 1.55% at 23,339 and the Dow Jones was lower by 0.34% at 49,241. Tech was the clear sectoral laggard with Communications Services and Healthcare the next worst hit, while Energy, Materials, Consumer Staples, and Utilities all saw gains in excess of 1%. Supporting Energy was strength in the crude complex after heightened US/Iran rhetoric. Tech was in focus with Palantir strong after accelerated growth and expanding profitability saw the stock rise over 6.8%. But software stocks got hammered as Anthropic launched its legal tool for its Claude AI chatbot – Salesforce, Adobe, Synopsys and Intuit were all down 7%+. Healthcare stocks were also under pressure after Novo Nordisk warned of a steep drop in 2026 annual sales which caused its ADR to plunge 14%. Walmart became the first retailer to hit the $1 trillion market cap level, as it attracted both high-end and lower-income customers, boosted by AI investment in its online marketplace.

Asian stocks: Futures are mixed. APAC stocks were higher after the solid Wall Street closes post strong IMS data. The ASX 200 was led by miners though the hawkish RBA capped the upside. The Nikkei 225 surged above 54,000 on yen weakness. The Hang Seng and Shanghai Comp saw tech weakness initially as the Hong Kong Tech Index briefly re-entered bear market territory after dropping more than 20% from its October high. However, Chinese markets then pared their losses alongside the broad rally in Asia.

Gold jumped with its biggest one day % move since 2009 as prices got near $5,000. Buyers stepped in with the long-term structural drivers still in place – elevated geopolitical risk, macro uncertainty, diversification flows and ongoing central bank buying. The latter bought less last year but remain key marginal buyers, while current price levels are likely to attract renewed interest. Near-term downside risks may persist as some traders continue to take profits. But the pullback looks more like a correction than the start of a new trend. Volatility will remain elevated.

Day Ahead – EZ Inflation, ISM Services

Consensus sees the Eurozone headline inflation print easing two-tenths to 1.7%, which is well below the ECB’s target of 2% over the medium term. The less volatile core, which strips out food and energy costs is forecast to remain unchanged at 2.3%. Lower services and fuel prices likely caused some disinflation. January figures can be volatile due to annual reweighting in the baskets and tax changes. The ECB is expected to keep an eye on hotter-than-expected wage growth going forward. A shock downside surprise in the headline could turn the bank more dovish at the margin. But the data is highly likely not to move the dial at the ECB ahead of Thursday’s unchanged policy meeting.

After the stellar ISM manufacturing data released on Monday, which saw the biggest expansion since 2022, we get all-important services figures. January non-manufacturing ISM is forecast to move lower to 53.5 from 54.4. The index is in its tenth straight month of expansion above 50. But other surveys point to muted new business growth as tariffs cause increased costs for services in January. The big upside surprise in manufacturing data caused a corresponding move in the dollar.

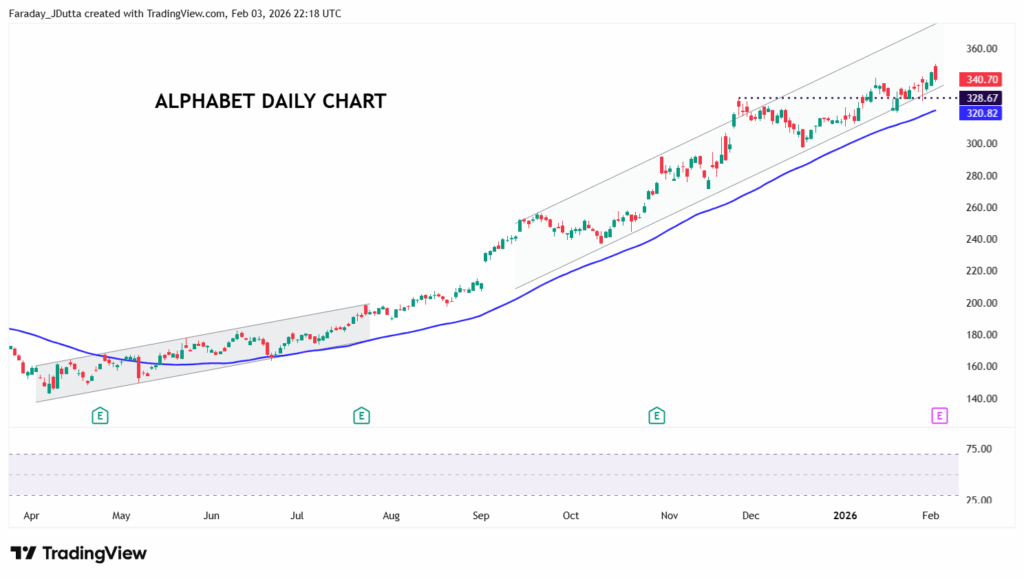

Chart of the Day – Record highs for GOOGL ahead of results

Google’s parent, Alphabet, reports its financial results after US markets close. Markets predict the stock could move +/- 5.1% in the trading session after the release. GOOGL has risen over 8.5% so far in 2026 to record highs with the market value of the company recently hitting $4 trillion. Focus areas in the release will be advertising growth in Search & YouTube. These are key assets and expanding partnerships, but any hint of slowing click growth or rising traffic‑acquisition costs could impact. Certainly, Cloud is still currently set to remain the star, with forecasts of roughly 30%+ revenue growth and margin expansion as AI workloads and Gemini‑driven demand ramp up.

Otherwise, updates on AI capex discipline will be key as investors want reassurance that operating margins can still grind higher, even as Alphabet spends big on data centres and its own chips. Expectations are sky-high with the stock near record highs. That means a clean beat and confident AI narrative keeps Alphabet in the market’s leadership pack. But any wobble in AI monetization, cloud growth or 2026 capex guidance will hurt, as the stock is priced for execution.