Two-way markets in stocks and precious metals

* Wall Street closed mixed; tech down amid more value and defensive rotation

* Gold volatile with run above $5,000 and close below

* Alphabet slipped after earnings beat but double capex spend

* ECB and BoE both expected to sit on their hands, awaiting data

FX: USD looked to break higher though prices were relatively quiet for a second day. The ADP employment report showed just 22,000 jobs added compared to 48,000 estimated. ISM Services printed modestly higher, while the employment component was softer. Overnight, US President Trump signed the $1.2tln spending bill to end the government shutdown. The delayed January NFP report will now be released next Wednesday, and CPI two days later.

EUR was the major outperformer, though it closed lower on the day versus the dollar. The latest inflation data came in line with estimates, with headline at 1.7% and core at 2.2%. A very neutral ECB meeting is predicted – see below for more.

GBP was midpack in the majors but cable dipped below the September highs and minor Fib level of the November low to January high at 1.3685. The BoE meeting looms though no rate changes are expected. See below for more details. Sentiment continues to dominate if the BoE springs no surprises.

JPY underperformed once more as prices moved above the 50-day SMA at 156.26. Ongoing expectations for a landslide victory by Japanese PM Takaichi’s ruling LDP at the snap election on Sunday continue to hurt the yen. That’s due to the prospect of looser fiscal policy and tax cuts, and a less independent Bank of Japan. A revved-up Takaichi trade means more JGB weakness with hotter inflation incoming.

US stocks: S&P 500 lost 0.51% to close at 6,883, the Nasdaq was down 1.77% at 24,891 and the Dow Jones was higher by 0.53% at 49,501. Energy, Materials, and Staples, the best three performing sectors this year, continue to see gains given their little exposure to the AI complex as rotation out of Tech continued. Healthcare was boosted by a strong Eli Lilly earnings report. The trillion dollar giant bucked the tech mood as it guided up to 27% sales growth as obesity demand surges; the stock jumped 10.3%.

The launch of the Anthropic legal tool for its Claude AI continued to reverberate with a global sell-off in data analytics, professional and software services firms. The US software and services index has plunged more than 12% in the last five days. Nvidia, Tesla and Broadcom were down over 3.5% while Palantir tumbled over 11%, giving back all its prior day’s gains. AMD got hit after posting weak Q1 forecasts and only mild beats, sinking more than 17%. Alphabet reported after the close and was trading modestly lower. It is adding $55bn to its capex plans further boosting AI spending with an increased forecast of $180bn for 2026. Google’s parent saw a second straight quarter of $100bn+ revenue driven by strong search ads and cloud.

Asian stocks: Futures are mixed. APAC stocks were mixed too on the Stateside tech sell-off. The ASX 200 edged up on mining strength but tech capped more upside. The Nikkei 225 slumped early on before moving off the lows with big Nintendo losses not helping the mood. The Hang Seng and Shanghai Comp saw two-way price action on better than expected China data but news that Nvidia chip sales had been stalled by a US security review.

Gold was volatile with gains above $5,500 given back through the US session as the dollar strengthened. Precious metals are less attractive to foreign buyers if their currencies weaken versus the greenback. It’s been a hugely volatile period with a record high at $5,598 a week ago, followed two days later by an intraday low at $4,402. Long-term drivers are still in play, but volatility is likely to stay elevated as markets continue to adjust positioning following the recent moves.

Day Ahead – BoE and ECB meetings

No policy changes are expected at the Bank of England with the Bank rate kept unchanged at 3.75%. After the knife-edge 5-4 vote last time, a 7-2 split is expected, though Ramsden could vote for a cut which would be dovish and hit sterling. Recent data has been mildly hawkish with stronger-than-expected GDP and PMIs, plus still sticky inflation. Wage growth is falling but is not deteriorating quickly enough to justify another rate cut. Policy is nearing neutral so decisions on more easing are becoming an even closer call on the already divided MPC. There’s currently around a 20% chance of a March rate cut and 36bps in total for 2026, much less than 50bps priced in a few weeks ago.

ECB policy is currently in a ‘good place’ which means the bank is fully expected to leave the deposit rate steady at 2%. Inflation is stable around 2%, though the latest headline print did dip as expected to 1.7%. Less volatile core is stable, and growth is better than forecast in Germany, Spain and Italy. President Lagarde is likely to keep the data dependent, meeting-by-meeting stance. Questions around the stronger euro may not materialise with this week’s dollar rebound, but in any event, are very likely be swatted away with a neutral Lagarde answer. There may not be any big market reaction.

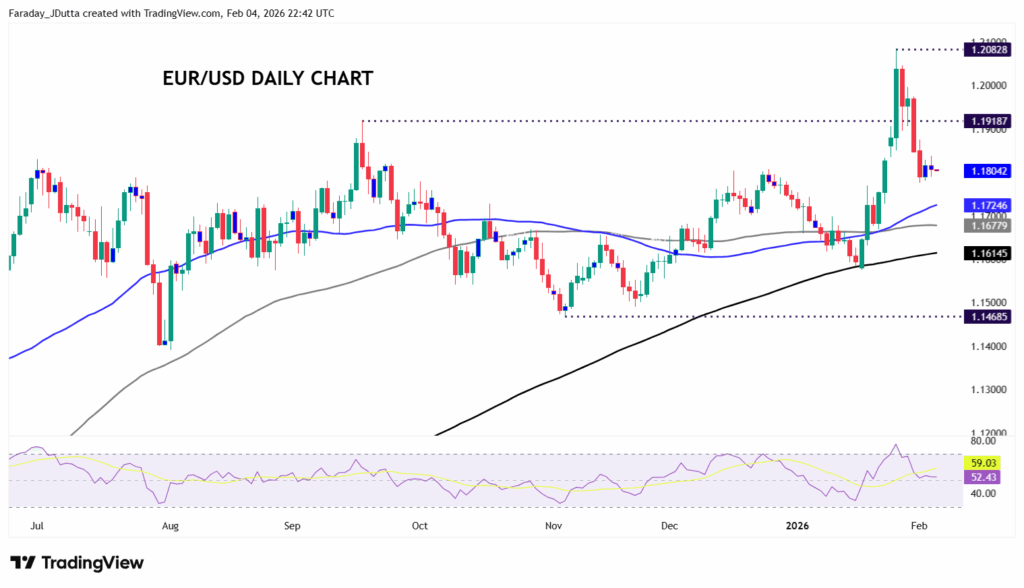

Chart of the Day – EUR/USD pulls back to support

The euro enjoyed a bullish upside move at the end of last month which it took above the September high at 1.918 and to a multi-year, near four-year top at 1.2082. But the very bearish weekly candle warned of a correction. The latest pullback has dragged momentum back to neutral with an RSI hovering just above the threshold at 50. The latest consolidation has found support around the upper bound of the prior 1.14/1.18 range, which capped prices in late December and July last year. Prices are now neutral, with support at the 50-day SMA at 1.1719 and near-term resistance at 1.1850 and 1.1918.