US Mega-Caps in Focus: NVDA, MSFT, AAPL

The US equity market remains the hottest market to watch, especially given the latest macroeconomic shifts that have reinvigorated bullish sentiment globally. Fed Chair Jerome Powell revealed a dovish tilt at the latest Jackson Hole symposium late last week, signalling that rate cuts are on the way. This revived market expectations for at least 1-2 rate cuts to be delivered by the Federal Reserve before the end of 2025.

It is important to note that the US is a laggard in terms of global monetary easing timelines. The Federal Reserve has opted to be prudent and delay rate cuts until they are certain that inflation can be kept well under control. However, as labour markets are now starting to show signs of weakening, it seems a pivot to monetary easing is now in place.

The last nonfarm payrolls showed that the US only added 73,000 new jobs to the economy, well below expectations of 110,000 new jobs being added. Moreover, the labour force participation rate remains low, signalling supply-side dynamics in the labour market are also weak.

Now, rate cuts have become more or less an inevitability this year. Such expectations for monetary easing are now supporting bullish spirits in the US stock market, despite equity valuations reaching peaks rarely seen previously. Moving forward, we could see the top performers in the US equity markets continue to shine amidst macroeconomic tailwinds.

NVDA – Tech’s Biggest Star Continues Shining

Nvidia (NVDA) has been the tech sector’s darling as the AI capex story continues to develop, helping the stock climb more than 30% YTD to become the first company to reach over US$4 trillion in market value. Nevertheless, some caution is due as many skeptics note that only the top performers in the AI sector generate positive returns. NVDA’s earnings next week will be a key focus, as markets see them as a barometer for the broader AI story.

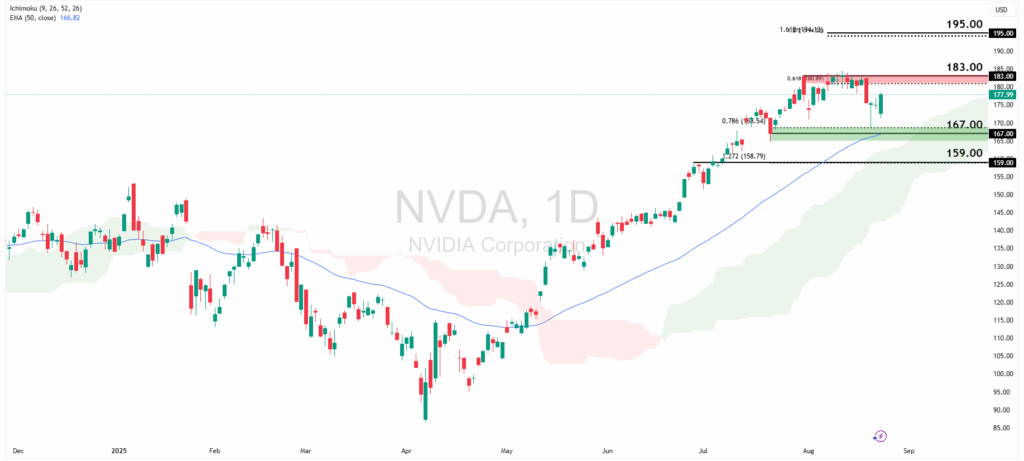

NVDA remains in an uptrend, holding above the 50-EMA and Ichimoku cloud. Continued bullish momentum post-earnings should push the price higher to retest the swing high resistance at the $183 level, in line with the 61.8% Fibonacci Extension level, or even towards the next $195 resistance, in line with the 127.2% Fibonacci Retracement and 161.8% Fibonacci Extension levels.

However, a deeper retracement could see the price dip below the 50-EMA and approach the $159 support, in line with the 127.2% Fibonacci Retracement level. At this point, a re-evaluation of bullish sentiment for the AI sector may be needed.

MSFT – Slow but Steady Momentum

MSFT continues to be a software giant commanding a wide array of services. Its most recent fiscal year results were supported by Azure and other cloud service offerings, as revenue rose 15% to US$281.7 billion, and operating income increased 17% to US$128.5 billion. Going forward, this consistent outperformer is expected to continue holding strong even as tech stocks falter in the past week.

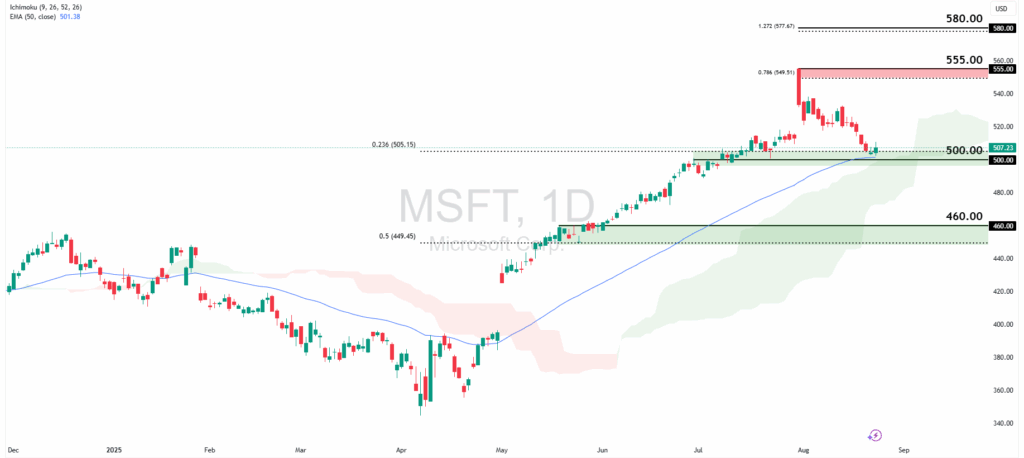

MSFT also maintains a bullish outlook and is now testing the $500 support, in line with the 23.6% Fibonacci Retracement and 50-EMA. A continuation of bullish momentum should see the price bounce from this level and move towards the swing high resistance at the $555 level, in line with the 78.6% Fibonacci Extension level. Further tech bullishness could also push the stock price higher towards the $580 resistance, in line with the 127.2% Fibonacci Extension level.

However, poor earnings or a shift to overall bearish sentiment in the US equity markets could send MSFT lower, towards the $460 support level, in line with the 50% Fibonacci Retracement level. At this point, the price would dip below key technical indicators such as the Ichimoku cloud and 50-EMA.

AAPL – New Developments Show Potential

AAPL is another beneficiary of tech sector bullishness. The company is also stirring up interest as the broader market is looking forward to how the overhaul of its key iPhone offering will play out with its customer base. The success of this move is likely to dictate how the stock will perform going forward, especially since it is a rare pivot under Tim Cook, who has mostly opted for a safer approach and stock buybacks to support the company.

AAPL has also been showing bullish price action as its pullback last week has been limited. If the price retests the $215 support, which is in line with the 50-EMA and an area of strong Fibonacci confluence, we are likely to see a bounce and a further bullish leg to the upside to test resistance levels at the $235 and $247.50.

However, bearish momentum taking over the market could push the price lower as well. If there is a convincing break and close below the $215 support, we could see it retest the swing low support at the $193.50 level.

Even as US equity markets continue to outperform, it would be prudent to consider how stretched valuations are. Information technology stocks also comprise 33.4% of the US market, showing a level of dominance rarely seen before. Nevertheless, the broader market looks resilient, as the equal-weighted S&P 500 index actually posted a 0.45% increase amidst a tech sector sell-off last Tuesday. Keep an eye on NVDA earnings this week, along with other economic data releases that could reaffirm resilience in the US markets.