Weekly Outlook | Dollar In Focus With Equities Rising. What’s Next?

The volatile moves in financial markets also continued throughout last week causing traders be on alert. Due to the particle shutdown in the United States this week will offer the Nonfarm Payroll report, which is being released this Wednesday. Apart from that the week will remain relatively light in terms of news events but likely continues to offer elevated volatility in general. The Silver market in particular continues to remain extremely volatile: The price corrected as much as 30% from its high above the level of USD 92 towards the USD 64 range before starting to rise again. With oil prices potentially still breaking higher, the focus should be on geopolitics. An increase of the conflict between Iran and the US might send prices higher quickly.

Important events this week:

– US Nonfarm payrolls report– The NFP report will be released on Wednesday this week and has been delayed due to the partial shutdown in the US. It is expected that the US economy had added 70.000 jobs during the last cycle, which would be an increase compared to the previous data release. The Dollar might continue to gear up some momentum, as the Greenback has been rising slightly in recent trading sessions.

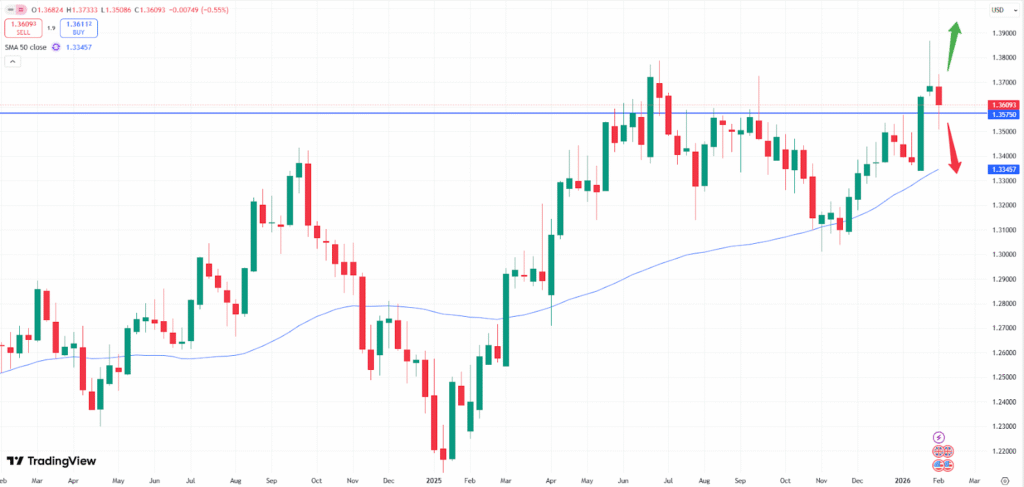

GBPUSD weekly chart

The GBPUSD currency pair remains in focus, here. The market did print a technical resistance candlestick pattern based on the weekly chart. With the pinbar candlestick, prices might remain below the technical resistance zone and could push lower. A push below the level of 1.3575 might cause the market to fall further, if prices remain capped below the tip of that candlestick. A push towards the 50- moving average zone due to positive trend in the labor market will help such move. The data will be released on Wednesday, 11th of February at 14:30 CET.

– US Consumer price index– The CPI index from the US will give more insights into the potential next moves of the Central Bank. If consumer prices continue to remain at elevated levels, the Fed might not be in a hurry to cut rates even further. It is expected that the release will offer a decline from 2.7% to 2.5% on an annual basis. This would then be slightly negative for the dollar and might cause the Greenback to lose momentum.

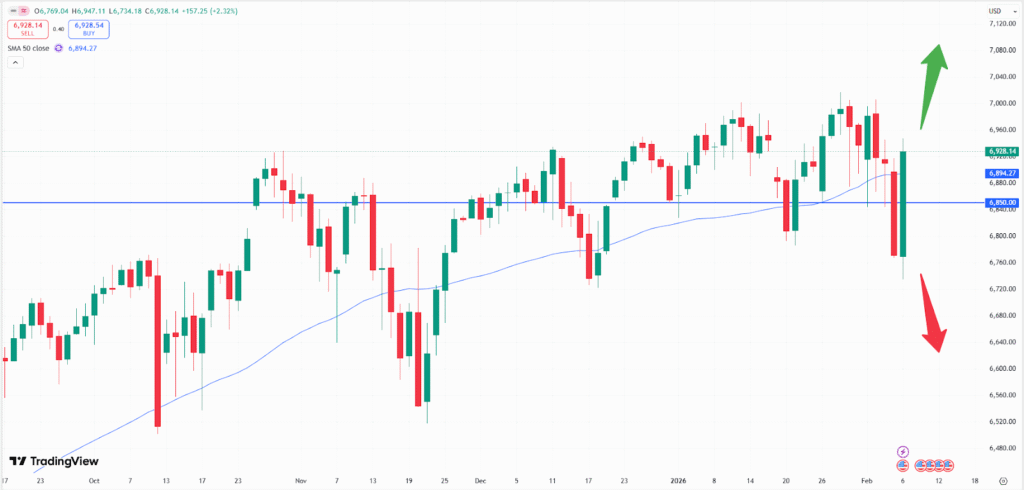

S&P 500 weekly chart

On the flipside the S&P 500 might then gear up steam. Falling consumer prices will increase the odds of cutting rates, which would also help the Dollar to weaken and then increasing the demand for equities. The S&P 500 index has been rising again last week on Friday after initially a negative trading week indicating a potentially break to higher levels. Especially a break above the 7,000-price level might indicate that the index could push higher.

Yet, if prices remain at or near the previous 2.7% level the index might weaken again, as the Federal Reserve Bank might stay on hold for now. The data will be released on Friday, 13th of February at 14:30 CET.