Weekly Outlook | Stronger Dollar and More Central Bank Action

After a busy trading week with several interest rate decisions also this week might offer fresh volatility in markets. While the shutdown in the United States continues the Dollar keeps gearing up some momentum, which might lead to some risk- off momentum in markets. A stronger Dollar usually causes equities to weaken and currencies like the AUD and NZD to weaken further. Furthermore, also precious metals and oil prices might be affected. Some downside momentum should hence be expected especially during the first trading days of this new month.

Newswise the Nonfarm payrolls report is expected to be delayed again. Also, the Core PCE price index might not be published. Traders might get some information with the release of the ADP report. The report is expected to show a slight increase in employment. Positive data might also help the Greenback to continue with potential strength.

Important events this week:

AU interest rate decision: The aforementioned weakness in “risky” assets like equities, and currencies like the NZD as well as the AUD might gear up steam. The interest rate decision is not expected to offer fresh insights as the rate is expected to remain the same. The recent release of the consumer price report revealed that prices in Australia are on the rise again. This strong message likely causes the RBA to leave rates unchanged. Usually, this causes a currency to strengthen but the positive momentum did not last long.

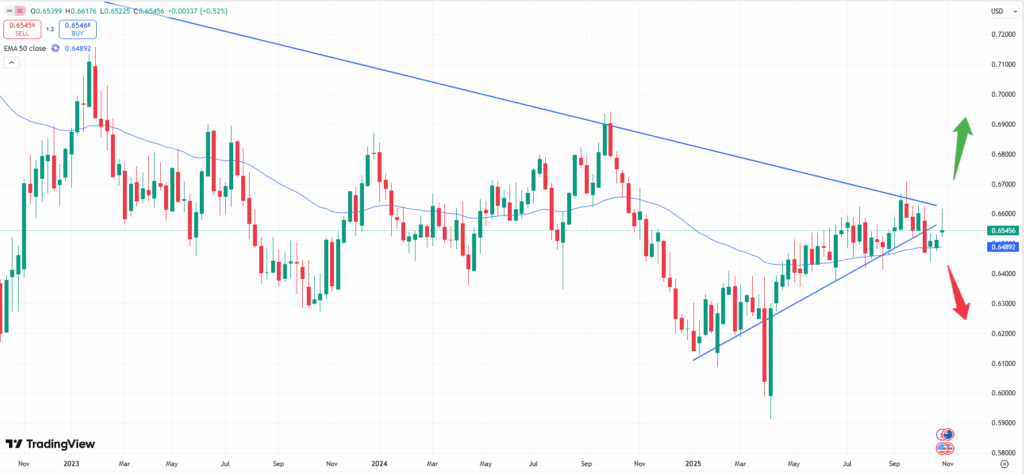

The weekly chart above shows, that the price tried to break higher last week but, in the end, failed to break to the upside. The technical pinbar candlestick pattern might now cause the AUD to weaken. Prices below 0.6500 level could be used as an entry, while a break of the 50- moving average at 0.6490 might indicate a further slide. The AUDUSD currency pair might then move towards the 0.6200 price range. The data will be released on Tuesday, the 02nd of November at 04:30 CET.

UK interest rate decision: The interest rate from the Bank of England is also expected to remain the same and currently sits at 4.00%. With the inflation still well above the 2% target the Bank will likely not act. Recent wage growth data also shows positive momentum. On the other hand, the economy is slowing, which also causes less demand for new labor.

A closer look at the long-term monthly chart of the GBPUSD currency pair reveals that the price went lower, especially during last the last trading week. Since the positive risk sentiment also in the equity market keeps fading, the Pound is losing some momentum. With the break of the recent low at 1.3200 from three months ago more downside momentum might now follow. Slightly rising prices could then be used to enter the market on the selling side. Given the trendline in the chart above potential targets could be found, should the Dollar continue with its strength for now. The interest rate decision will occur on Thursday, the 06th of November at 13:00 CET.